ScholarshipOwl conducts month-to-month surveys to assist us to achieve deeper perception into Gen Z’s views about faculty, scholarships, monetary help, and their future. In November, we requested college students about what they’ve realized about pupil loans from their dad and mom to gauge how that will have impacted the scholars’ selections about whether or not or to not tackle pupil debt. Whereas 83% of respondents indicated that their dad and mom have mentioned the benefits and downsides of pupil loans, the overwhelming majority of respondents nonetheless will graduate with pupil debt. What stood out probably the most was that 88% of respondents will graduate with debt, whereas solely 52% of their dad and mom needed to do the identical.

The quickest path to incomes scholarships

Simplify and focus your software course of with the one-stop platform for vetted scholarships.

Who participated within the survey?

In November 2023, ScholarshipOwl surveyed highschool and faculty college students on the ScholarshipOwl scholarship platform to be taught extra about their views in regards to the worth of faculty. A complete of 6545 college students responded.

Among the many respondents, 62% have been feminine, 36% have been male, and a pair of% recognized themselves as different. Practically half (49%) have been Caucasian, 21% have been Black, 16% have been Hispanic/Latino, 6% have been Asian/Pacific Islander and 6% recognized as different.

Greater than half (58%) of the respondents have been highschool college students, with the overwhelming majority highschool seniors; over one-third (34%) have been faculty undergraduate college students, primarily faculty freshmen and faculty sophomores; 5% have been graduate college students and three% recognized themselves as grownup/non-traditional college students.

Survey questions

Query 1

We started the survey by asking college students, “Have your dad and mom talked to you in regards to the benefits and downsides of pupil loans?” The overwhelming majority (83%) stated sure, whereas lower than one-fifth (17%) stated no.

Query 2

The following query was, “Have your dad and mom inspired you to take out pupil loans to assist cowl faculty prices?” Practically half of the scholars (46%) responded sure, whereas simply over half (54%) stated no.

Query 3

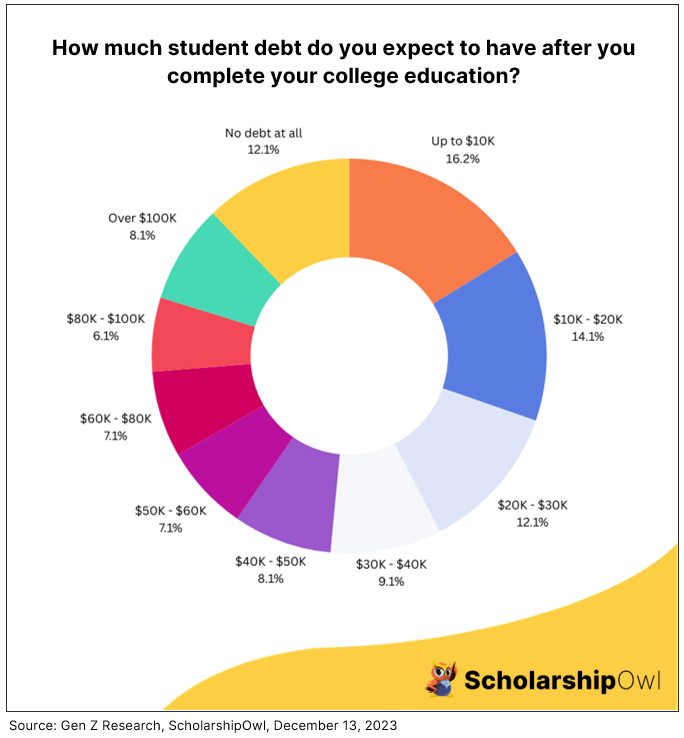

We needed to be taught the impression of those conversations with dad and mom on pupil decision-making relating to pupil loans. We requested college students, “How a lot pupil debt do you count on to have after you full your faculty schooling?” General, 88% of respondents count on to graduate with some quantity of pupil debt. The complete breakdown:

- 16% count on to graduate with as much as $10,000 in pupil debt

- 14% count on to graduate with $10,001 to $20,000 in pupil debt

- 12% count on to graduate with $20,001 to $30,000 in pupil debt

- 9% count on to graduate with $30,001 to $40,000 in pupil debt

- 8% count on to graduate with $40,001 to $50,000 in pupil debt

- 7% count on to graduate with $50,001 to $60,000 in pupil debt

- 7% count on to graduate with $60,001 to $80,000 in pupil debt

- 6% count on to graduate with $80,001 to $100,000 in pupil debt

- 8% count on to graduate with greater than $100,000 in pupil debt

- Simply 12% indicated that they’d not graduate with any pupil debt

Query 4

The ultimate query was, “In case your mum or dad(s) went to school, did they graduate with pupil debt?” Amongst all college students surveyed, 5232 (66%) indicated that their dad and mom attended faculty. Amongst these college students, 52% stated that their dad and mom graduated with pupil debt, whereas 26% stated no. Some respondents (13%) weren’t positive if their mum or dad(s) graduated with pupil debt.

Key takeaways

The excellent news is that the overwhelming majority (83%) of fogeys are speaking with their youngsters in regards to the benefits and downsides of pupil loans, nevertheless it’s disheartening to see that just about half of those dad and mom (46%) are encouraging their youngsters to tackle pupil debt to pay for school. And amongst these surveyed whose dad and mom went to school, solely about half of these dad and mom (52%) graduated with pupil debt, but 88% of the scholars surveyed count on to graduate with pupil. Whereas these outcomes are disappointing, they aren’t shocking. In response to a 2021 research from Georgetown College, the price of faculty has skyrocketed 169% since 1980, but earnings for younger adults between the ages of twenty-two and 27 have elevated by simply 19%.

Analysis performed by the Financial Coverage Institute signifies that wages have stagnated for the reason that 1970’s. Center-income employees have seen solely a 6% enhance of their wages since 1979, and low-income employees have truly seen their wages fall 5%. But these with the very best wages have seen a 41% enhance, starkly demonstrated by the truth that CEOs earn 296 instances greater than typical employees inside their trade.

Whereas it’s optimistic that folks are serving to to coach their youngsters in regards to the benefits and downsides of pupil loans, dad and mom additionally want to make sure that their youngsters perceive tips on how to forge an reasonably priced path to school – a path that doesn’t embody taking up pupil debt.

How can college students afford faculty with out taking up pupil debt?

Somewhat than taking up pupil loans, college students can use debt-free sources to pay for school as a substitute:

- Entry federal and state grant help by submitting the FAFSA.

- Prioritize making use of for scholarships with ScholarshipOwl.

- Work part-time in the course of the faculty 12 months and full-time throughout breaks. Apply your earnings towards your faculty schooling.

- Select a extra reasonably priced path to school, similar to by beginning at a group faculty.

Dad and mom and college counselors must encourage college students to use for scholarships and jobs, NOT loans, enabling college students to graduate debt-free. There IS an reasonably priced path to school – for additional data, and to begin making use of for scholarships, go to www.scholarshipowl.com.