Dental Pupil Loans: Your Full Information

It comes as no shock that dentists usually graduate from dental college with mortgage-sized dental pupil loans. Based on a research from the American Dental Schooling Affiliation (ADEA), solely 17% of dentists reported having no training debt. The median dental college mortgage steadiness for brand spanking new grads in 2021 was $301,583. However there are various of you on the market strapped with a lot larger debt masses within the $300k-$500k+ vary. Those that concentrate on orthodontics, oral surgical procedure, periodontics, pediatrics, and many others., could have even larger pupil mortgage balances attributable to borrowing in residency.

Dental pupil mortgage debt is much more burdensome amongst youthful dentists, as tuition prices have continued to skyrocket through the years. Sadly, wage will increase haven’t been commensurate with tuition will increase, placing some dentists in an much more precarious place with respect to their dental college mortgage debt.

Paying for dental college can get overwhelming shortly. There are federal loans and non-public loans with totally different guidelines, eligibility, and compensation plans. There’s non-public refinancing, consolidation, forbearance, and many others. Simply determining what these things means would possibly require hours and hours of analysis poring over pupil mortgage literature. However don’t fear, SLA can assist stroll you thru it.

In the event you need assistance understanding the terminology, try our Pupil Mortgage Phrases glossary.

Dental pupil loans can impression a dentist’s potential to:

- Save for retirement

- Buy a house

- Get married or have youngsters

- Attend medical appointments

- Repay bank cards

- Begin their very own follow

- And rather more

StudentLoanAdvice.com (SLA) was created to supply a third-party choice to assist dentists, docs, and excessive earners get monetary savings on their pupil loans. Our staff of pupil mortgage consultants have met with many dentists making them a number of the most educated within the trade. The coed mortgage panorama is rising extra advanced every day with a mess of compensation plans and mortgage forgiveness choices—every with various benefits and drawbacks which contact in your earnings, tax-filing standing, and even the way you’re contributing for retirement. It’s no shock that a lot of our shoppers, previous to our consultations, had been making five- and six-figure errors by mismanagement of their pupil loans.

For a number of hundred {dollars}, we’ll meet with you one-on-one, overview your state of affairs, and offer you a custom-made pupil mortgage plan that will help you optimize your pupil mortgage administration.

This put up discusses a number of the fundamentals of pupil loans for dental college, compensation plans, and pupil mortgage debt forgiveness choices.

Desk of Contents:

How Do Pupil Loans Work for Dental College?

Dental college pupil loans are issued to dental college students to finance their training and related residing bills. They don’t seem to be for use for every other objective. Not like a mortgage or auto mortgage, collectors don’t have any direct asset to grab in case you default. As such, they are usually supplied at charges considerably larger than mortgage charges, normally round 5%-8%.

Pupil loans are virtually by no means discharged in chapter. Nonetheless, typically they are going to be discharged attributable to loss of life or complete and everlasting incapacity. They can be discharged in case your college closes earlier than you full your program or if the establishment defrauds you and different college students.

How A lot Pupil Mortgage Cash Ought to I Borrow for Dental College?

Don’t borrow extra money than you want for dental college. Monetary support places of work could suggest taking out extra loans to cowl residing bills. If that is needful in your state of affairs, take out the least quantity essential to cowl your residing bills. A few of your pals could borrow greater than they should reside a lavish life-style on their loans. That is by no means a good suggestion.

Each greenback of mortgage cash you spend finally ends up costing you extra by the point you pay it again. Reside, however be aware that the gallon of milk you simply purchased truly price you $15 or the steak dinner actually price $300.

How Do I Obtain Dental College Loans?

Your dental college’s web site or monetary support workplace will direct you to the federal pupil support kind or FAFSA kind to obtain pupil loans. After filling out the shape, federal pupil support will offer you particulars in your monetary support package deal.

Previous to receiving federal pupil loans, you’ll full entrance counseling and signal a authorized doc referred to as a grasp promissory notice wherein you promise to comply with the mortgage obligations. You probably have extra questions, contact your college’s monetary support workplace.

Monetary support places of work could provide different forms of federal and non-federal loans but it surely varies by establishment. Be taught extra about non-federal loans under.

Mortgage Corporations for Dental College

Pupil mortgage lenders are normally the federal government, a faculty, or a personal lender. In the event you apply on FAFSA for a pupil mortgage, you’ll obtain a pupil mortgage from the federal authorities. At present, nearly all of federal pupil loans are referred to as direct federal pupil loans. Studentaid.gov is the house web site the place they’ve all your mortgage info.

Your dental college can lend to you immediately by institutional loans and/or Perkins loans. These loans are usually not as frequent as direct federal pupil loans or non-public loans issued by non-public lenders.

If you wish to obtain extra loans, you’ll have to contact a personal lender. A non-public lender is often a financial institution or monetary establishment that can challenge loans for training. Non-public loans have much less flexibility and protections than federal loans.

Though federal loans come from the federal authorities, it usually outsources the mortgage servicing. Mortgage servicers handle the day-to-day points of your mortgage funds. Not like federal loans, non-public lenders will usually challenge and repair your pupil loans.

What Is a Pupil Mortgage Servicer?

A pupil mortgage servicer oversees the administration of your pupil loans. Your servicer will hold observe of your month-to-month funds, forgiveness credit, late funds, relevant tax varieties, fee historical past, and many others. Periodically, your pupil mortgage servicer can change. You’ll be instructed by way of e-mail or snail mail when this occurs. Be sure you log in frequently to make sure your contact info is updated.

Paying for Dental College: Federal vs. Non-public Pupil Loans

At any time when doable, we suggest you are taking out federal pupil loans earlier than non-public loans when paying for dental college. There isn’t a restrict on how a lot you’ll be able to borrow federally for dental college. As well as, federal pupil loans are likely to have decrease rates of interest initially and a plethora of federal protections that personal pupil loans don’t provide. Reminiscent of:

- Earnings-Pushed Reimbursement (IDR) – fee primarily based on earnings

- Public Service Mortgage Forgiveness (PSLF) – 10-year tax-free mortgage forgiveness

- Taxable Earnings-Pushed Reimbursement Forgiveness – 20-25 yr taxable mortgage forgiveness

- Loss of life and Incapacity Discharge – pupil loans are discharged tax-free within the occasion of loss of life or complete and full incapacity

- Forbearance – briefly placing federal pupil mortgage funds on maintain whereas non-public loans provide little to no flexibility in case you can’t make your funds

Federal Pupil Loans

Federal pupil loans are the commonest sort of loans dental college students borrow to finance their training. They arrive with a wide range of mortgage sorts, compensation plans, and mortgage forgiveness choices. Most US dental colleges will qualify for federal pupil loans, however for individuals who attend dental college exterior of the US will more than likely must look to the non-public sector for pupil loans.

Sponsored vs. Unsubsidized Federal Pupil Loans

Sponsored federal pupil loans don’t develop or accrue curiosity if you are in class. Sponsored loans had been discontinued for dental college packages in 2012, and they’re now solely supplied on the undergraduate stage. Those that attend dental college now or who’re planning to attend should make the most of unsubsidized loans. These loans start accruing curiosity the second you obtain them.

Sorts of Federal Pupil Loans

There are 5 essential forms of federal pupil loans to contemplate.

New debtors primarily want to grasp two mortgage sorts, direct Stafford loans and grad PLUS loans. If you find yourself borrowing for dental college the primary $20,500 per semester will likely be direct Stafford loans. In the event you want loans above that quantity they may challenge you grad PLUS loans. Grad PLUS loans are issued with a better rate of interest and mortgage charges than direct Stafford loans. Grad PLUS loans don’t have any borrowing cap. Those that have already borrowed for dental college (and for different education) probably have a mixture of the under mortgage sorts.

Direct Stafford Loans

Stafford Loans originated from the William D. Ford Federal Direct Mortgage (Direct Mortgage) Program. Direct Stafford Loans are the commonest pupil loans and are at the moment being issued to assist cowl the price of larger training.

Grad PLUS Loans

Grad PLUS Loans, aka Graduate PLUS Loans, come from the Direct and Household Federal Schooling Mortgage (FFELP) packages. Debtors are issued these loans to cowl tuition after exhausting Stafford Loans.

Father or mother PLUS Loans

Father or mother PLUS Loans are issued to folks to finance their youngster’s training. They’re supplied for undergraduate, graduate, {and professional} diploma college students. Mother and father will normally take out these loans if their youngster can’t cowl their tuition by federal pupil loans. Mother and father are responsible for the loans and finally liable for them. There isn’t a cap on federal borrowing for graduate {and professional} diploma packages so that you shouldn’t ever have to make use of these when borrowing for dental college.

Household Federal Schooling Mortgage (FFELP) Program

Earlier than 2010, the Household Federal Schooling Mortgage (FFELP) Program was the principle supply of federal pupil loans. This system resulted in 2010, and it’s now defunct. Virtually all federal loans are actually issued underneath the Direct Mortgage program referred to above. However for individuals who nonetheless have these older loans, there are totally different guidelines relevant to this mortgage program.

Perkins Loans

The Federal Perkins Pupil Mortgage program was created to supply cash for faculty college students with decrease earnings or distinctive monetary want. This system ended on September 30, 2017.

Perkins Loans all have a 5% rate of interest and are issued by the college you attend. They’re backed and received’t accrue curiosity whereas enrolled in class.

Well being Assets and Companies Administration Loans (HRSA)

Except for the commonest federal pupil loans listed above, the Well being Assets and Companies Administration (HRSA) additionally points pupil loans completely to US healthcare professionals who display a monetary want pursuing their healthcare training. HRSA loans are need-based and include service necessities which encourage debtors to follow in underserved communities. All of those loans are backed (authorities pays curiosity throughout college) and have a 5% fastened rate of interest. Every has its personal compensation phrases, forgiveness, and deferment eligibility.

Federal Reimbursement Applications

There are a selection of federal compensation plans to contemplate when figuring out which compensation plan is finest for you. Commonplace, Graduated, and Prolonged compensation are primarily based in your mortgage quantity, size of compensation, and rate of interest. Earnings-Pushed Reimbursement relies in your earnings and family measurement.

- Commonplace Reimbursement Plan – fastened funds over 10 years

- Graduated Reimbursement Plan – funds begin at a decrease quantity and improve each two years at a price to repay the mortgage over 10 years

- Prolonged Reimbursement Plan – fastened funds over 25 years

- Earnings-Pushed Reimbursement (IDR) Plans – funds are calculated as a proportion of discretionary earnings. IDR plans are a requirement for Public Service Mortgage Forgiveness (PSLF).

Extra on Federal Pupil Mortgage Reimbursement Applications

Methods to Enroll right into a Federal Reimbursement Plan

Your mortgage servicer will ship you a notification to enroll right into a compensation plan whenever you graduate. In the event you don’t choose a plan, you’ll be in the usual 10-year plan. In the event you’d prefer to be positioned within the graduated or prolonged compensation plan, name your mortgage servicer and request to be positioned on that plan.

Most debtors with federal loans ought to enroll into an IDR plan. REPAYE or PAYE are the very best IDR plans. You might also want to contemplate Outdated IBR and ICR. In the event you’d prefer to enter an IDR plan, you’ll have to fill out an Earnings-Pushed Reimbursement Software kind. There’s an digital and paper kind software.

In the event you’d like help with choosing a compensation plan, schedule an appointment with a pupil mortgage professional.

How A lot Will My Pupil Mortgage Cost Be?

Your pupil mortgage fee can rely on a wide range of elements, resembling your compensation plan, earnings, family measurement, tax submitting standing, and many others. Right here’s a calculator that will help you learn the way a lot your fee can be.

Bonus Tip: There are a selection of Federal Pupil Mortgage Statuses you want to concentrate on to make sure you don’t pay additional in the long term or eradicate the chance for forgiveness.

How Do I Decrease My Month-to-month Cost on Dental College Loans?

Funds on dental college loans will be lowered in numerous methods for each federal and personal pupil loans.

Federal Pupil Loans

-Enroll in an Earnings-Pushed Reimbursement (IDR) plan as a substitute of the usual 10-year, graduated or prolonged compensation plan.

-Non-public refinance your federal pupil loans right into a decrease rate of interest. Usually, this could offer you a decrease fee.

Non-public Pupil Loans

-Prolong your mortgage time period.

-Non-public refinance your loans to a decrease rate of interest.

-Add a co-signer with sturdy credit score whenever you non-public refinance your pupil loans. Be aware, the co-signer turns into collectively responsible for the debt in the event that they co-sign.

Strategies to cut back month-to-month funds in Earnings-Pushed Reimbursement Plans

-Contribute to pre-tax accounts, resembling a 401(ok), 403(b), 457, TSP, Well being Saving Account (HSA), and Versatile Spending Account (FSA).

-File taxes as a pair married submitting individually (MFS)—be taught extra about this technique right here.

Non-public Pupil Loans for Dental College

Non-public Pupil Loans are usually taken out by college students who’ve maxed out their federal borrowing restrict for the yr when borrowing for undergrad. With graduate {and professional} diploma packages, there isn’t a cap on federal borrowing. Federal pupil loans ought to all the time be taken out earlier than non-public.

Eligibility Necessities for Non-public Pupil Loans

Most debtors will obtain non-public pupil loans from a personal lender. In the event you determine to take out a personal pupil mortgage, an underwriter will have a look at your credit score rating, debt-to-income ratio, financial savings, and job historical past to find out your creditworthiness. Most have to be a US citizen, everlasting resident, or have a co-signer who’s. Additionally, you should be of authorized age to borrow. This varies by state.

Non-public Pupil Mortgage Reimbursement Plans

There are 4 essential methods to repay your non-public pupil loans. Be suggested: the longer your fee time period, the extra curiosity you’ll find yourself paying.

- Fast Reimbursement – month-to-month funds start primarily based on a five-, 10-, 15-, or 20-year time period. That is the bottom price choice of the 4 compensation choices.

- Curiosity-Solely – month-to-month funds solely protecting the curiosity.

- Partial – usually an choice for individuals who are nonetheless in class or do residency who want to make a low fastened fee. Be aware, this is quite common throughout coaching.

- Full Deferment – not required to make funds in class, but it surely’s the costliest choice of the 4.

Extra on Non-public Mortgage Reimbursement and which choice to decide on

Pupil Mortgage Administration for Dentists

For many dentists, it’s endorsed to contemplate mortgage forgiveness or non-public refinancing. Happening both of those routes is normally extra advantageous than sticking with a typical, graduated, or prolonged compensation for federal pupil loans. In case you are contemplating mortgage forgiveness, you’ll more than likely want to contemplate federal pupil mortgage consolidation. Skip this part in case you simply plan on non-public refinancing.

Federal Pupil Mortgage Consolidation

Federal pupil loans will be consolidated. Throughout this course of, quite a few loans are all lumped collectively into one mortgage (or two in some circumstances), and the rates of interest are averaged after which rounded as much as the closest 1/eighth of a %. That is distinct and totally different from the method of personal refinancing, the place the rate of interest is usually lowered and loans are transformed from federal to personal.

Financially, typically the benefit of finishing a direct federal consolidation is that it makes you eligible for various compensation plans and forgiveness choices. In the event you’re a brand new grad or quickly will likely be, a direct federal consolidation can will let you decide out of the automated six-month grace interval that you just’ll enter whenever you graduate. This might will let you begin paying your loans sooner and start credit score to mortgage forgiveness earlier.

Please notice: whenever you full a consolidation, it would erase your prior fee historical past in your mortgage(s). This is a crucial consideration in case you’re doing mortgage forgiveness. This rule will likely be modified starting July 1st, 2023. While you consolidate your direct pupil loans, they may take a weighted common of present qualifying funds towards PSLF. Right here’s an instance underneath the proposed guidelines: say you may have 100k of loans at 90 months and 100k of loans at 30 months. In the event you consolidate them you’d have a brand new qualifying fee depend of 60 on all your loans.

Pupil Mortgage Forgiveness for Dentists

Most pupil mortgage forgiveness packages that dentists ought to contemplate are for federal pupil loans.

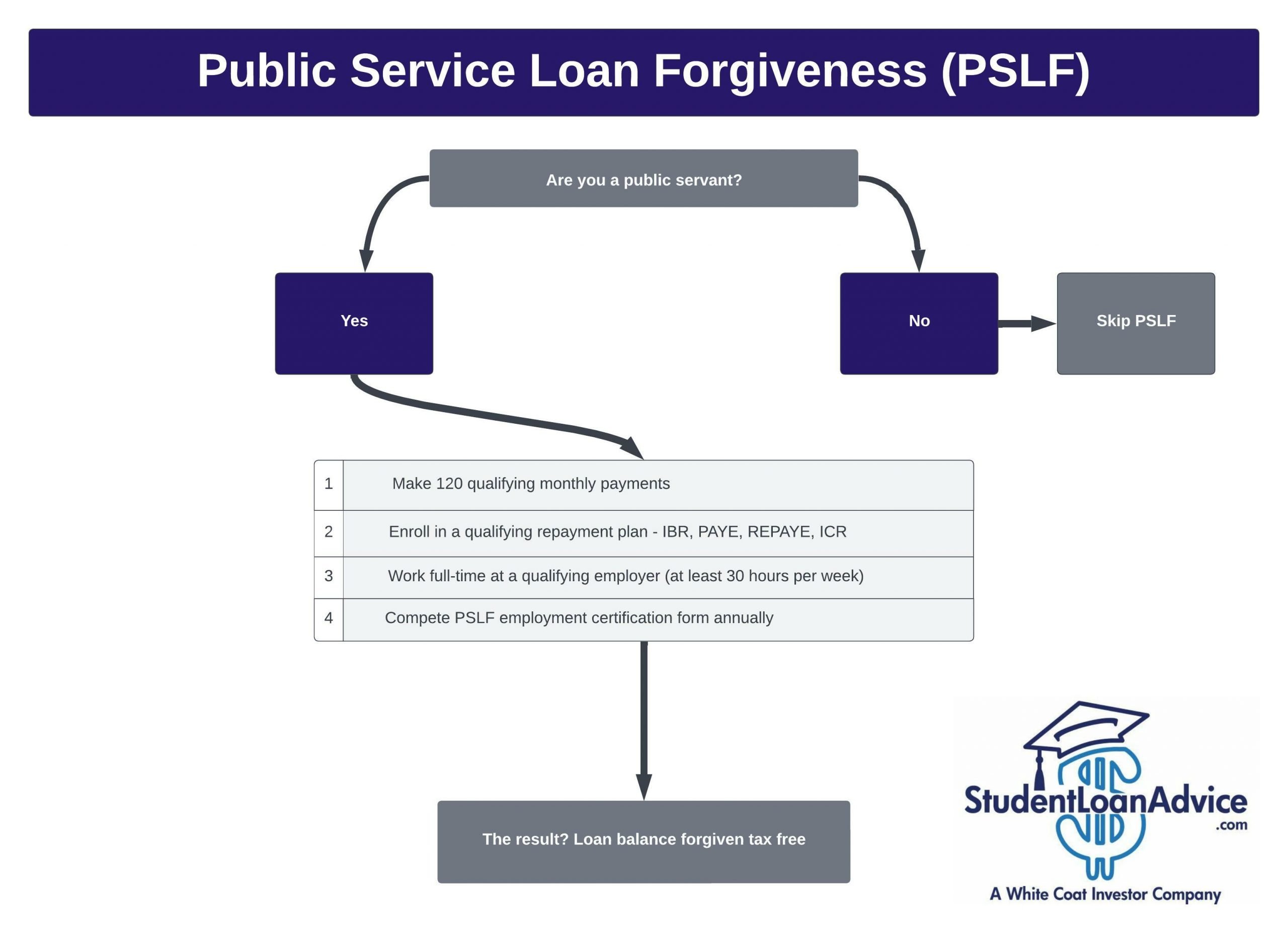

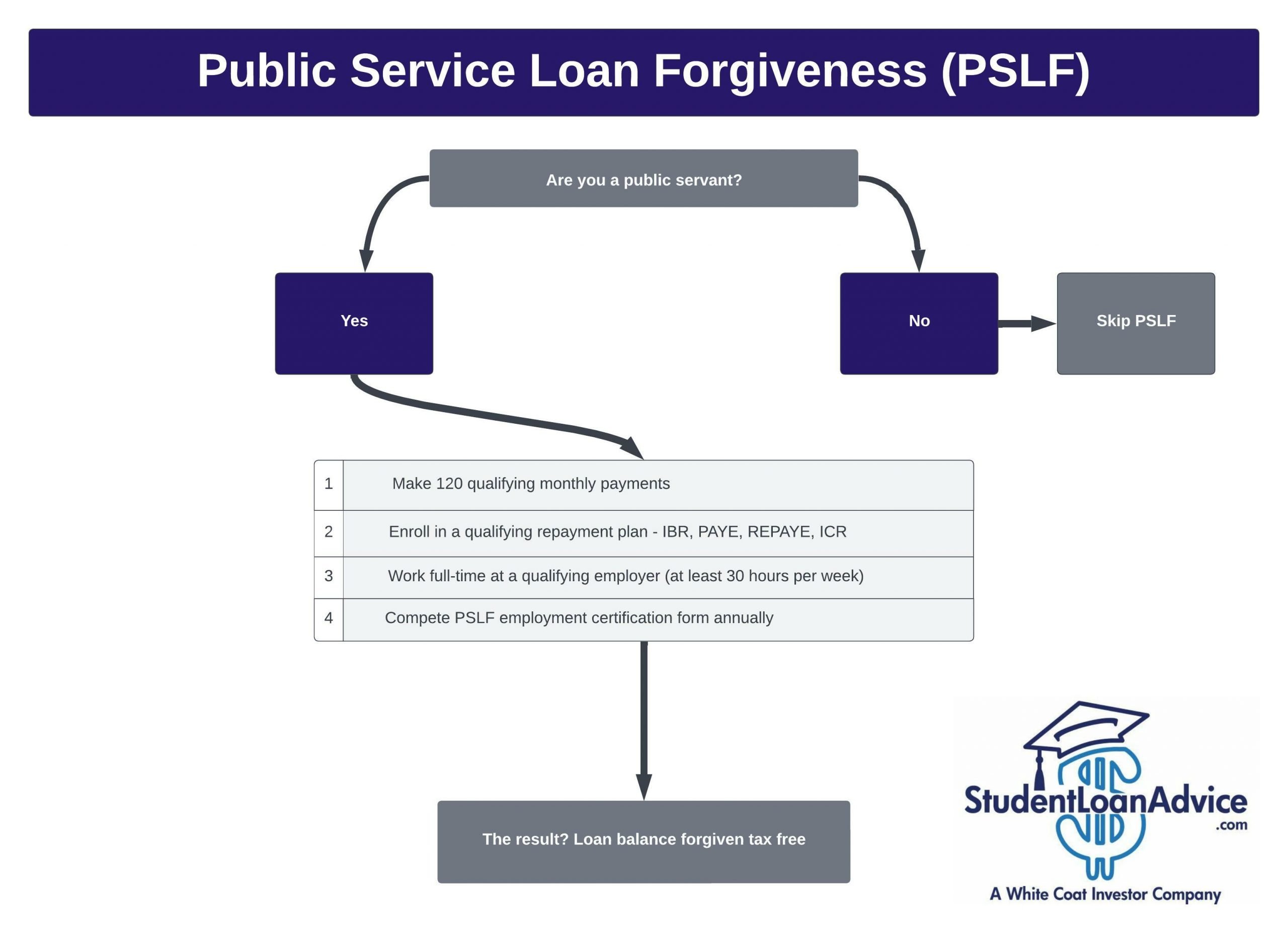

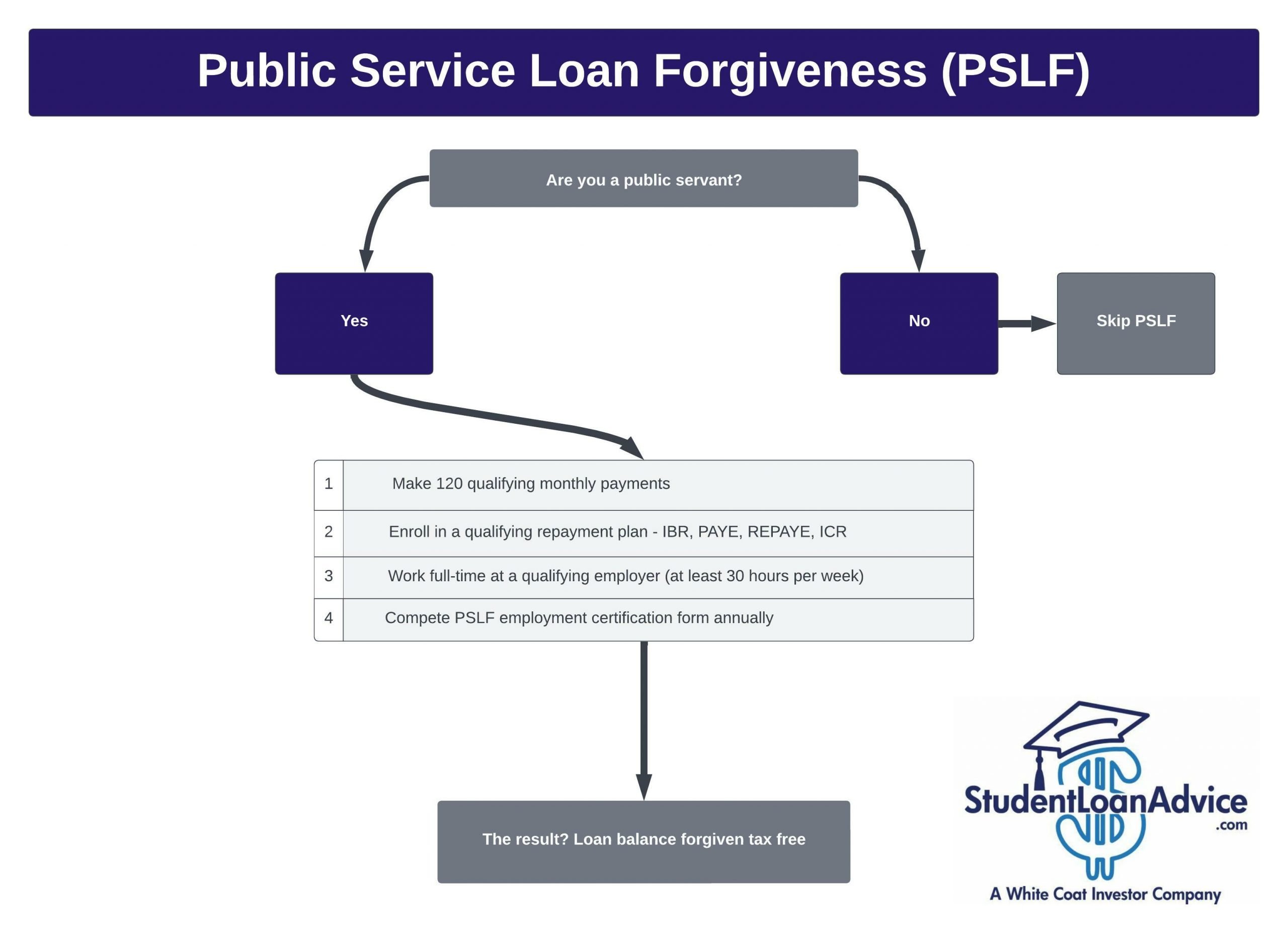

Public Service Mortgage Forgiveness (PSLF)

Public Service Mortgage Forgiveness or PSLF is the very best mortgage forgiveness program on the market. Not like your friends who go to medical college, most dentists will pursue a profession in non-public follow or dental service group (DSO). Dentists in non-public follow or DSO’s are usually not eligible for the PSLF program. In the event you’re a dentist who works (or plans to) in a non-profit or 501(c)(3) you must undoubtedly contemplate PSLF.

Who Is Eligible for PSLF?

Typically talking, any borrower is eligible who works for a nonprofit group or for the federal government. Use the PSLF assist software to find out in case your employer qualifies.

What Sorts of Loans Are Eligible for Forgiveness?

Direct federal loans (unsubsidized and backed), direct graduate PLUS, and direct consolidation loans are eligible for PSLF.

What Are the Necessities of PSLF Mortgage Forgiveness?

- Make 120 qualifying month-to-month funds. These are cumulative funds, not consecutive.

- Enroll in a qualifying compensation plan—IBR, PAYE, REPAYE, ICR, or the usual 10-year compensation. Be aware: in case you enroll in the usual 10-year fee plan and make funds for 10 years, there will likely be nothing left to forgive.

- Work full-time at a qualifying employer or the equal of full-time throughout a number of companies or organizations (at the least 30 hours p/wk). Certified employers are usually the federal government and nonprofits. Watch out as employers will typically be for-profit however affiliated with a authorities or nonprofit entity. FMLA will depend in case you don’t take greater than 12 weeks and proceed to make month-to-month funds.

- Submit a PSLF certification kind to confirm your employment at a certified employer and hold observe of funds. It’s advisable to submit this manner at the least yearly to assist servicers hold observe of funds. A residency program director, HR supervisor, payroll worker, and many others., would have the ability to signal it.

How A lot Can Dentists Have Forgiven By way of PSLF?

Any excellent mortgage quantity (principal and curiosity) will likely be forgiven tax-free after you may have accomplished 120 qualifying funds. You’ll obtain a refund in case you’ve paid greater than 120 funds on direct loans.

Please notice that it’s essential to be extraordinarily meticulous together with your record-keeping and guarantee your mortgage servicer is accurately categorizing (or counting) every of your month-to-month funds. Finishing the PSLF certification kind yearly is one of the simplest ways to mitigate your servicer’s errors. Your servicer will probably make errors in your software, and also you’ll have to appropriate them.

How Lengthy Does It Take to Have Loans Forgiven By way of PSLF?

PSLF takes about 10 years to finish.

Please notice: There’s a momentary leisure of numerous these necessities. Examine it right here.

Taxable Earnings-Pushed Reimbursement Forgiveness

Taxable Earnings-Pushed Reimbursement (IDR) Forgiveness is a extra frequent mortgage forgiveness choice for dentists than PSLF. Nonetheless, your pupil mortgage debt must be 2.5, 3, 4x+ your earnings for this to be helpful. We hardly ever suggest any dentist pursue this program. We solely see this as an choice for individuals who keep as an affiliate, work part-time or which have large quantities of pupil debt.

This forgiveness observe is kind of advanced. In the event you’re contemplating taxable IDR forgiveness, we suggest you schedule a time with knowledgeable at SLA.

Who Is Eligible for Taxable Earnings-Pushed Reimbursement Forgiveness?

Debtors enrolled in income-driven compensation packages are eligible.

What Sorts of Loans Are Eligible?

Direct federal loans (unsubsidized and backed), direct consolidation loans, Father or mother PLUS loans if consolidated (ICR solely), and FFEL loans.

What Are the Necessities?

Be enrolled in an income-driven compensation program. Make month-to-month funds. Full the annual income-driven compensation (IDR) certification.

How A lot Could Be Forgiven?

The excellent mortgage quantity will likely be forgiven after you may have accomplished the fee time period. The forgiven quantity will likely be taxed for debtors receiving this forgiveness after 2025. The taxed forgiven quantity is sometimes called the “tax bomb” as a result of the taxes paid within the yr the loans are forgiven will be large. The tax bomb makes this program a lot much less interesting except you save up for it alongside the way in which. Arrange a aspect fund to arrange for the tax bomb. That is an account the place, periodically (usually suggested month-to-month), you’ll contribute cash to an funding account of your option to put aside sufficient cash to pay the tax invoice within the yr your federal loans are forgiven.

How Lengthy Does Taxable Earnings-Pushed Reimbursement Forgiveness Take?

- REPAYE – 20 years for undergrad, 25 years for graduate.

- PAYE – 20 years.

- IBR – 25 years (20 years for debtors who took out loans after July 1, 2014).

- ICR – 25 years.

In the event you’d prefer to discover extra forgiveness choices, please see our put up on Pupil Mortgage Forgiveness Applications.

Refinance Dental College Loans

The aim of refinancing dental college loans is to decrease the rate of interest in your pupil loans and to pay much less curiosity. You may refinance federal and personal pupil loans collectively. Of all of the strategies to pay down pupil loans we mostly see dentists non-public refinance their pupil loans.

Federal Pupil Loans

In the event you’ve determined pupil mortgage forgiveness just isn’t best for you, you must undoubtedly contemplate non-public refinancing. Don’t maintain on to these excessive federal pupil mortgage rates of interest (6%-8%) longer than wanted.

Right here’s an instance of two dentists:

Dentist 1: dental pupil loans 200K, rate of interest 7%, 10-year time period

Dentist 2: dental pupil loans 200K, rate of interest 3%, 10-year time period

Dentist 2 made decrease month-to-month funds and, in complete, paid $46,914 much less in curiosity

Non-public Pupil Loans

Anytime you’ll be able to obtain a decrease rate of interest by non-public refinancing, it’s endorsed you achieve this to pay the minimal quantity on curiosity. Non-public lenders will have a look at your credit score, job historical past, earnings, financial savings, and debt. The higher you might be in every of those classes, the higher price you’ll usually obtain. Make certain to take a look at charges throughout these inflection factors in your profession.

- Dental college commencement to affiliate

- Resident to affiliate

- Make accomplice in your follow

- Marriage to a different earner

Mortgage Reimbursement Help Applications (LRAPs)

Mortgage compensation help packages (LRAPs) are packages which assist pay down your federal and personal pupil loans. There are various LRAPs accessible to debtors in case you work in particular states, be a part of the navy, work in a high-need space, and rather more.

See our information on LRAPs to be taught extra.

Do Dental Specialties Require Further Pupil Loans?

Turning into a dental specialist could be a nice choice on your profession as a dentist to extend your earnings. However, most dental specialties include extra price. Extra years in coaching and extra years accumulating pupil loans can initially set you again financially. Simply as you need to borrow for dental college, many who pursue dental residency should borrow as effectively. And, we typically see these in residency borrowing extra per yr than they did in dental college.

Not like your medical college friends, most dental residencies are unpaid except you might be related to a hospital. Most often, solely dental surgical residents received’t must pay tuition and will likely be paid a wage.

The typical basic dentist we meet with owes $407k in dental college loans and the common orthodontist we meet with owes $530k. Clearly, their profession earnings can differ fairly considerably as effectively. Be sure you issue within the extra price of residency when deciding in your profession as a dentist.

Conclusion

In case your head is spinning after studying by this information, you’re not alone. This was the case once we first discovered about these things, too. It’s tough and nuanced, and it may be hectic when deciding how finest to handle your pupil loans. This explains why we frequently establish five- or six-figure errors our shoppers had been making previous to their session with us.

Schedule your session with us at StudentLoanAdvice.com, and also you’ll obtain a custom-made pupil mortgage plan that can prevent hours of analysis and stress and doubtlessly 1000’s of {dollars}. Begin down the trail towards monetary independence by letting us information you thru your finest pupil mortgage choices.

Are you able to deal with your pupil loans?

Be part of our neighborhood of docs, dentists and excessive earners. Every month you’ll get our FREE e-newsletter with all the information and tips that will help you save $$ in your pupil loans.