Each month, ScholarshipOwl conducts surveys to assist us to achieve a deeper understanding of Gen Z, particularly concerning their readiness for faculty. Given the present financial circumstances, we determined to focus final month’s survey on college students’ capacity to afford school within the coming faculty yr. We had anticipated that almost all of scholars wouldn’t but have the funds wanted, however we had been shocked to study that over half (56%) of the scholars mentioned that they haven’t but secured any funds in any respect from scholarships, federal or state grants, revenue from a job, private financial savings or funds from household for faculty subsequent yr.

Who participated within the survey?

In January 2024, ScholarshipOwl surveyed highschool and school college students on the ScholarshipOwl scholarship platform to study extra about their views concerning the worth of school. A complete of 9,762 college students responded.

Among the many respondents, 60% had been feminine, 39% had been male, and 1% recognized themselves as different. Practically half (47%) had been Caucasian, 21% had been Black, 18% had been Hispanic/Latino, 6% had been Asian/Pacific Islander and 6% recognized as different.

The quickest path to incomes scholarships

Simplify and focus your utility course of with the one-stop platform for vetted scholarships.

Practically two-thirds (61%) of the respondents had been highschool college students, with the overwhelming majority highschool seniors; almost one-third (32%) had been school undergraduate college students, primarily school freshmen and school sophomores; 6% had been graduate college students and a couple of% recognized themselves as grownup/non-traditional college students.

Survey questions

Query 1

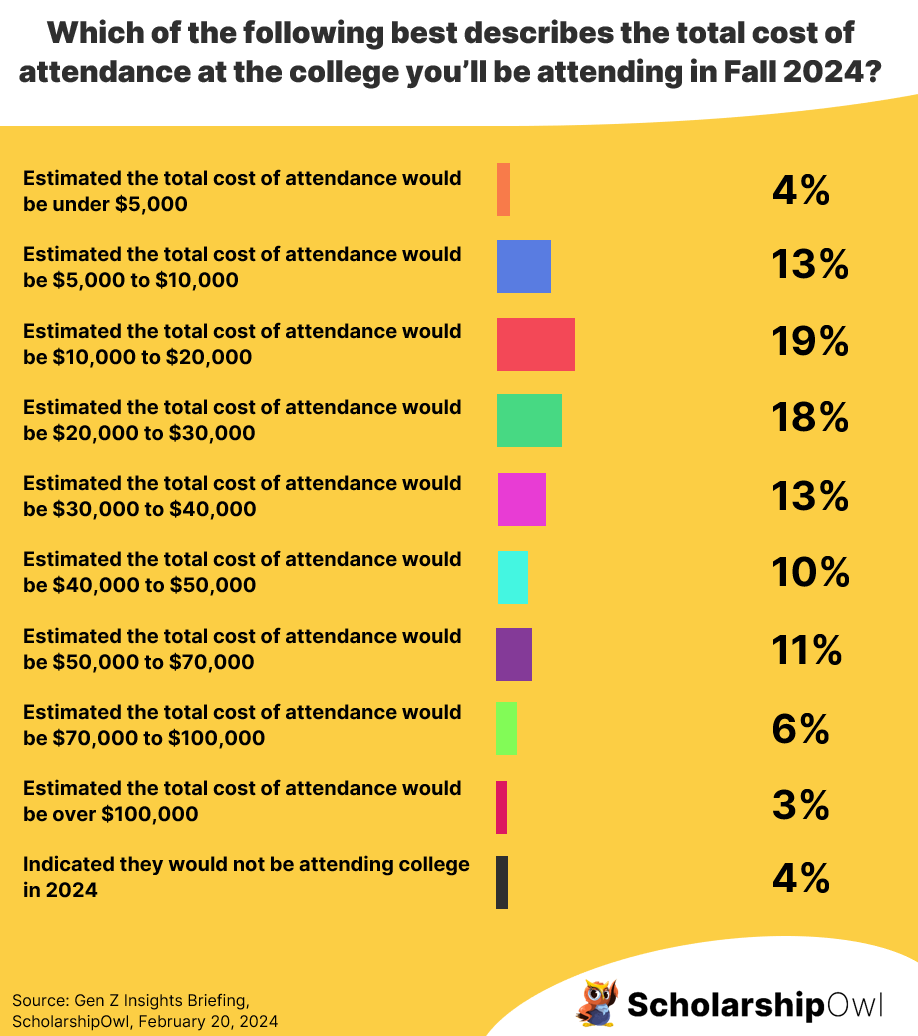

We started the survey by asking college students, “Which of the next finest describes the full price of attendance (tuition & charges, room & board, books/provides, and so on) on the school you’ll be attending in Fall 2024?”

- 4% mentioned the full price of attendance could be below $5,000

- 13% mentioned the full price of attendance could be $5,000 to $10,000

- 19% mentioned the full price of attendance could be $10,000 to $20,000

- 18% mentioned the full price of attendance could be $20,000 to $30,000

- 13% mentioned the full price of attendance could be $30,000 to $40,000

- 10% mentioned the full price of attendance could be $40,000 to $50,000

- 11% mentioned the full price of attendance could be $50,000 to $70,000

- 6% mentioned the full price of attendance could be $70,000 to $100,000

- 3% mentioned the full price of attendance could be over $100,000

- 4% indicated that they might not be attending school in Fall 2024

Query 2

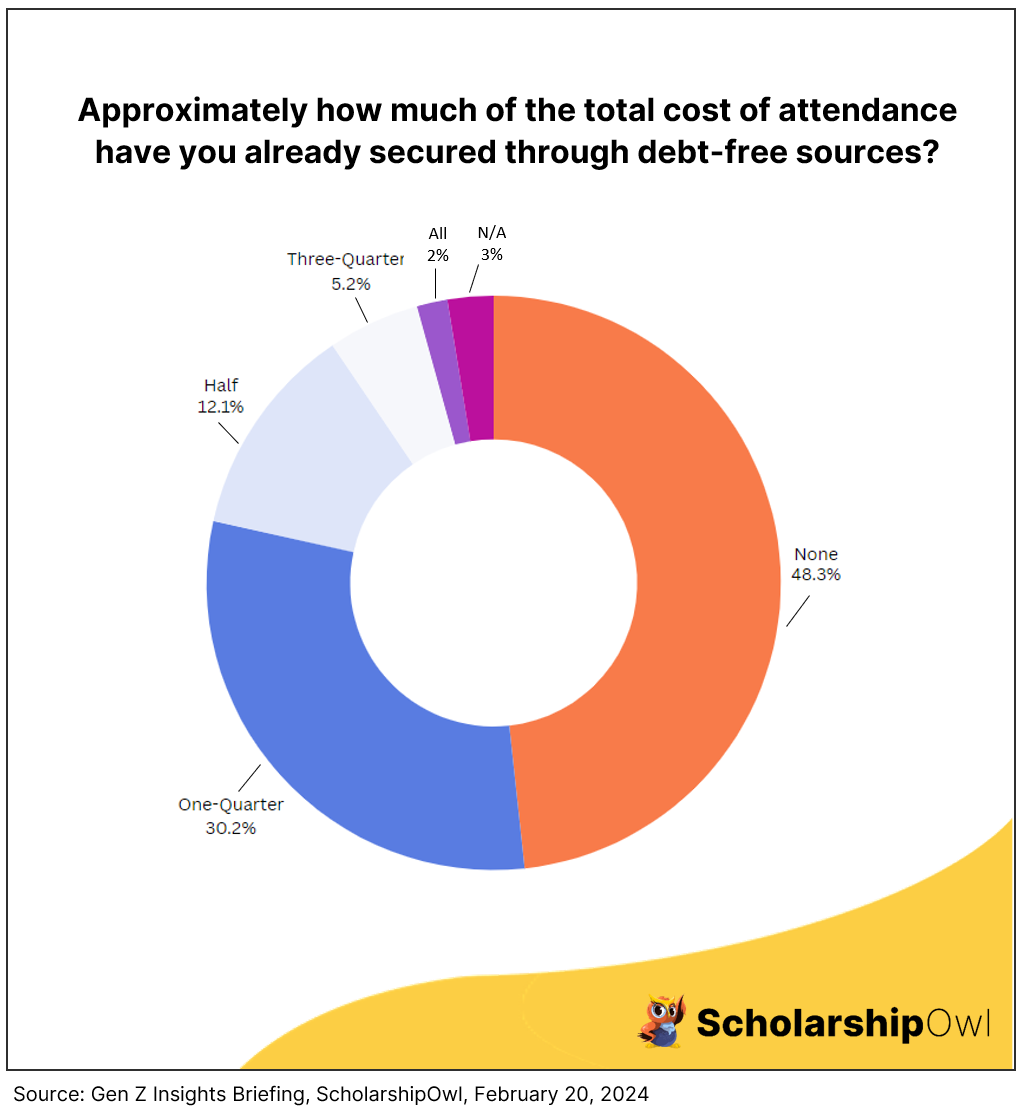

The subsequent query was, “Roughly how a lot of the Fall 2024 whole price of attendance have you ever already secured by debt-free sources comparable to scholarships, federal and/or state grants, revenue from a job, financial savings, cash from household, and so on?”

- 56% mentioned they’ve not one of the funds wanted

- 35% mentioned they’ve one-quarter of the funds wanted

- 14% mentioned they’ve half of the funds wanted

- 6% mentioned they’ve three-quarters of the funds wanted

- 2% mentioned they’ve all the funds wanted

- 3% mentioned they might not be attending school in Fall 2024

Query 3

Our last query was, “Which of the next sources do you anticipate you’ll use probably the most to cowl the remainder of your school prices?” College students had been capable of choose only one reply.

- 16% chosen need-based federal and/or state grants

- 15% chosen scholarships from their school/college

- 11% chosen exterior/non-public scholarships

- 1% chosen federal work-study

- 15% chosen revenue from a job

- 3% chosen financial savings

- 8% mentioned they might ask dad and mom/household to offer further monetary help

- 26% chosen scholar loans

- 2% chosen non-public loans

- Lower than 1% mentioned they have already got all of their school prices coated

- 3% mentioned they might not be attending school in Fall 2024

Key takeaways

Based mostly on this survey, it’s clear that almost all of scholars should be educated concerning the precise price of school. The common price of attending an in-state public college is about $26,000 per yr; attending an out-of-state college or non-public school can price anyplace from $40,000 to $70,000 per yr. But over one-third (36%) of the scholars responding to this survey anticipate that the full price of attendance for his or her school subsequent yr might be below $20,000.

It was additionally an eye-opener to find that greater than half of the scholars surveyed (56%) say they haven’t but secured any debt-free funds for faculty subsequent yr. Maybe a few of these college students is probably not conscious of school funds that their households have began for them, however even when that’s true, far too most of the respondents do not know how they’ll be capable to pay for faculty subsequent yr.

Whereas not stunning, it was nonetheless disappointing to study that almost one-third of scholars are planning to “fund their monetary help hole” with loans as their main funding supply. With so many choices for debt-free sources to pay for faculty, college students and households want to contemplate loans as last-resort funds, relatively than a go-to selection.

The place can college students and households study extra about the price of school?

Each school lists the full price of attendance on their web site. Typically this data is usually a bit exhausting to search out. The simplest approach to bounce to this data is to seek for “whole price of attendance” within the web site’s search bar.

Normal details about the common whole price of attendance of schools can be discovered on the Training Information Initiative web site.

What are some debt-free sources college students can entry to pay for faculty?

Scholar loans ought to at all times be a last-resort possibility for paying for faculty. Deal with debt-free sources that may allow you to graduate with out the burden of owing 1000’s of {dollars} for faculty. Right here is how college students pays for faculty with out loans:

- Entry federal and state grant help by submitting the FAFSA.

- Prioritize making use of for scholarships with ScholarshipOwl.

- Apply for scholarships from the colleges you’re making use of for and/or are at present attending.

- Work part-time in the course of the faculty yr and full-time throughout breaks. Save your earnings to make use of to your school schooling.

- Select a extra inexpensive path to varsity, comparable to by beginning at a neighborhood school.

Dad and mom and faculty counselors must encourage college students to use for scholarships and jobs, NOT loans, enabling college students to graduate debt-free. There IS an inexpensive path to varsity – for additional data, and to start out making use of for scholarships, go to www.scholarshipowl.com.