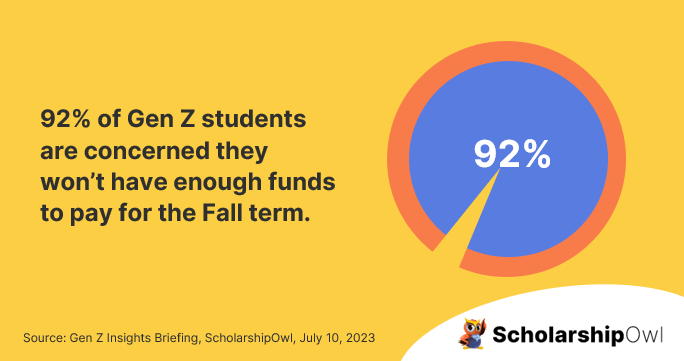

ScholarshipOwl conducts a month-to-month survey to raised perceive the priorities and pursuits of Gen Z college students. In June, we investigated whether or not or not Gen Z college students have the funds wanted to pay for prices related to the upcoming Fall time period, together with tuition, room and board, books and provides, and so forth. Sadly, our outcomes present that the overwhelming majority (92%) of respondents are involved that they received’t have sufficient funds to pay for the Fall time period.

Who participated within the survey?

In June 2023, ScholarshipOwl surveyed over 9,300 highschool and faculty college students on the ScholarshipOwl scholarship platform to study extra about how they plan to cowl looming faculty prices. We had been significantly all for discovering out if college students have already got the funds they want for the Fall time period, and for individuals who have a spot to cowl, we wished to understand how they plan to “fund their hole.” A complete of 9,323 college students responded to the survey.

Among the many respondents, 65% had been feminine, 34% had been male, and a pair of% recognized themselves as different. Almost half (43%) had been Caucasian, 26% had been Black, 17% had been Hispanic/Latino, 7% had been Asian/Pacific Islander and seven% recognized as different.

The quickest path to incomes scholarships

Simplify and focus your software course of with the one-stop platform for vetted scholarships.

A couple of-third (35%) of the respondents had been highschool college students, with the overwhelming majority highschool seniors; over half (53%) had been faculty undergraduate college students, primarily faculty freshmen and faculty sophomores; 9% had been graduate college students and 4% recognized themselves as grownup/non-traditional college students.

Survey questions

The primary survey query was “If you’ll be enrolled in faculty subsequent 12 months, what funding sources have you ever already lined as much as pay to your tuition, charges, room & board, books & provides, and so forth? Test all that apply.”

The overwhelming majority of respondents indicated that they might use multiple supply of funds, with most specializing in debt-free sources. Greater than half of scholars choosing federal or state grant help (53%), and greater than half (56%) choosing scholarships. The overwhelming majority indicated that they might be accessing earnings from employment, with practically half (49%) stating that they might use earnings from a job this summer season to assist pay for school, and greater than half (53%) saying that they might use earnings from a part-time or full-time job through the college 12 months to cowl faculty prices. A couple of-third (36%) can have some degree of economic help from dad and mom/household. As well as, many college students indicated they might be taking up debt that might have to be paid again, with greater than one-third (39%) might be taking out a number of federal scholar loans, and 14% might be taking out a number of personal scholar loans to cowl prices. A minority (4%) indicated that they might not be enrolled in faculty within the coming college 12 months.

We then requested, “Are you involved that you just received’t have sufficient funds to pay for the Fall time period?” We found to our dismay that the overwhelming majority (92%) of all college students surveyed responded “sure,” that they’re involved they received’t have sufficient funds for the Fall time period.

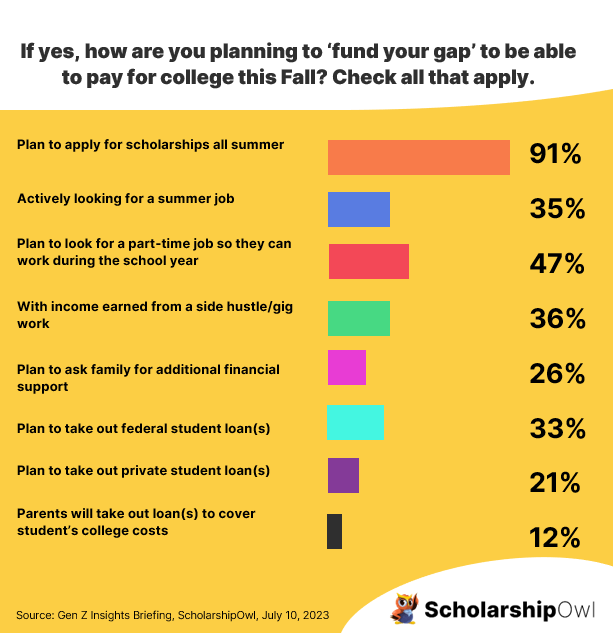

The ultimate survey query was “If sure, how are you planning to ‘fund your hole’ to have the ability to pay for school this Fall? Test all that apply.” Most respondents chosen a number of methods that they plan to make use of to cowl faculty prices. The overwhelming majority (91%) indicated that they plan to use for scholarships all through the summer season. Many college students are planning to make use of earnings from employment to cowl prices, with greater than one-third (35%) stating that they’re actively searching for a summer season job, and practically half (47%) saying that they plan to search for a part-time job on or close to campus in order that they’ll work all through the college 12 months. A couple of-third (36%) plan to earn earnings by means of a aspect hustle / gig work, equivalent to driving for a meals supply service or ride-sharing app, taking up freelance work, dog-walking, handyperson duties, and so forth. Over one-quarter of respondents (26%) are planning to ask household for extra monetary help. Many respondents indicated that they might be “funding their hole” with loans – One-third (33%) plan to take out a number of new federal scholar loans, and 21% plan to take out a number of new personal scholar loans. And 12% say that their dad and mom will take out loans to cowl their faculty prices. A small proportion (4%) indicated that they won’t be enrolled in faculty within the coming college 12 months.

Key takeaways for Gen Z college students

The survey outcomes point out that Gen Z college students are conscious of the a number of avenues they’ll entry to have the ability to cowl faculty prices, and the excellent news is that they’re primarily centered on sources that don’t should be repaid (federal and state grants, scholarships, earnings from employment). That stated, greater than one-third plan to take out scholar loans, even when additionally they have non-loan funding sources. The outcomes additionally point out that college students are counting on their dad and mom/households for monetary help, with greater than one-third already receiving help from household, and one-fifth planning to ask for extra household help to “fund their hole.”

Manufacturers will be the answer

Clearly, there nonetheless are usually not practically sufficient debt-free sources out there to help the hundreds of thousands of scholars who’ve a funding hole to fill earlier than the Fall time period begins. Extra scholarships are sorely wanted, and the companies and organizations that provide them have to do a greater job of reaching the scholars who’re in search of them. Manufacturers will help by providing scholarship campaigns by means of the ScholarshipOwl for Enterprise platform. By means of this platform, manufacturers can create and launch scholarship campaigns, and promote them to the hundreds of thousands of scholars who apply for scholarships on the ScholarshipOwl platform. This advantages each college students and types, enabling companies to construct relationships with Gen Z in help of their advertising and marketing and communication objectives.

To seek out out extra about creating and launching a scholarship marketing campaign, go to enterprise.scholarshipowl.com.