In February and March 2024, ScholarshipOwl performed a survey to assist us to realize a deeper understanding of how the rollout of the brand new Free Software for Federal Pupil Help (FAFSA) has impacted Gen Z college students. Media retailers have reported on quite a lot of points with the rollout of the brand new FAFSA which have resulted in delays with college students submitting the FAFSA, in addition to delays with college students receiving monetary help affords from faculties. In line with the Nationwide Faculty Attainment Community’s FAFSA Tracker, simply 34% of this yr’s highschool seniors had submitted the brand new FAFSA as of March 22, 2024, which is down 29% in comparison with final yr. As well as, technical points have triggered a number of delays in transmitting correct pupil knowledge to the universities, stopping faculties from with the ability to ship monetary help affords to college students. All of this has created a snowball impact that’s extensively anticipated to result in a major drop in school enrollment for the 2024-25 college yr and past. Based mostly on this, our survey outcomes weren’t stunning, however they have been sobering, with 21% of FAFSA-eligible college students indicating they haven’t but submitted the brand new FAFSA for 2024-25. Of the scholars who’ve efficiently submitted their FAFSA for the 2024-25 college yr, simply 16% had acquired a minimum of one monetary help provide from a school.

Who participated within the survey?

In February and March 2024, ScholarshipOwl surveyed highschool and school college students on the ScholarshipOwl scholarship platform to find out about how the rollout of the brand new FAFSA has impacted them. A complete of 11,394 college students responded.

Among the many respondents, 62% have been feminine, 36% have been male, and a pair of% recognized themselves as different. Almost half (47%) have been Caucasian, 21% have been Black, 17% have been Hispanic/Latino, 7% have been Asian/Pacific Islander and 6% recognized as different.

The quickest path to incomes scholarships

Simplify and focus your software course of with the one-stop platform for vetted scholarships.

Over half (58%) of the respondents have been highschool college students, with the overwhelming majority highschool seniors; one-third (33%) have been school undergraduate college students, primarily school freshmen and school sophomores; 6% have been graduate college students and three% recognized themselves as grownup/non-traditional college students.

Survey questions

Query 1

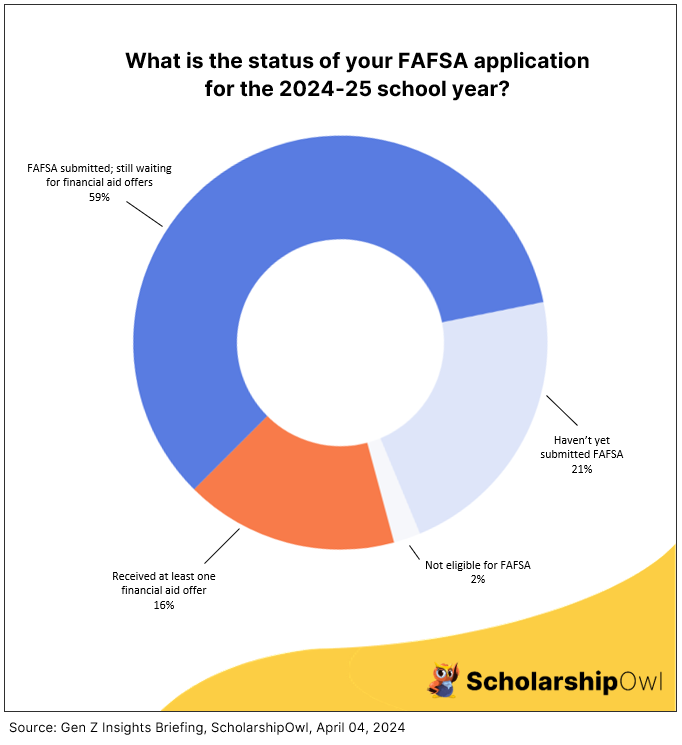

We started the survey by asking college students, “What’s the standing of your FAFSA software for the 2024-25 college yr?”

- 16% mentioned they’d submitted the FAFSA and have already acquired a number of monetary help affords;

- 57% mentioned they’d submitted the FAFSA, however they haven’t but acquired any monetary help affords;

- 21% mentioned they are going to be attending school in 2024-25, however they haven’t but submitted the FAFSA;

- 3% mentioned they gained’t be attending school in 2024-25, so that they gained’t be submitting the FAFSA;

- 2% mentioned they they don’t seem to be eligible to submit the FAFSA as a result of they don’t seem to be a U.S. Citizen or Everlasting Resident

Query 2

The subsequent query was, “When you have acquired a number of monetary help affords from faculties for the 2024-25 college yr already, which of the next have been included in your monetary help provide(s)? Choose all that apply.”

- 64% mentioned they haven’t but acquired any monetary help or scholarship affords for 2024-25;

- 11% mentioned they have been provided a Pell Grant and/or different federal grant(s);

- 8% mentioned they have been provided grant(s) or scholarship(s) from their state of residence;

- 21% mentioned they have been provided college grant(s) or scholarship(s);

- 3% mentioned they have been provided personal/exterior scholarship(s);

- 3% mentioned they have been provided federal work-study;

- 2% mentioned their mother and father have been provided a Guardian Plus mortgage;

- 3% mentioned they gained’t be attending school in 2024-25.

Query 3

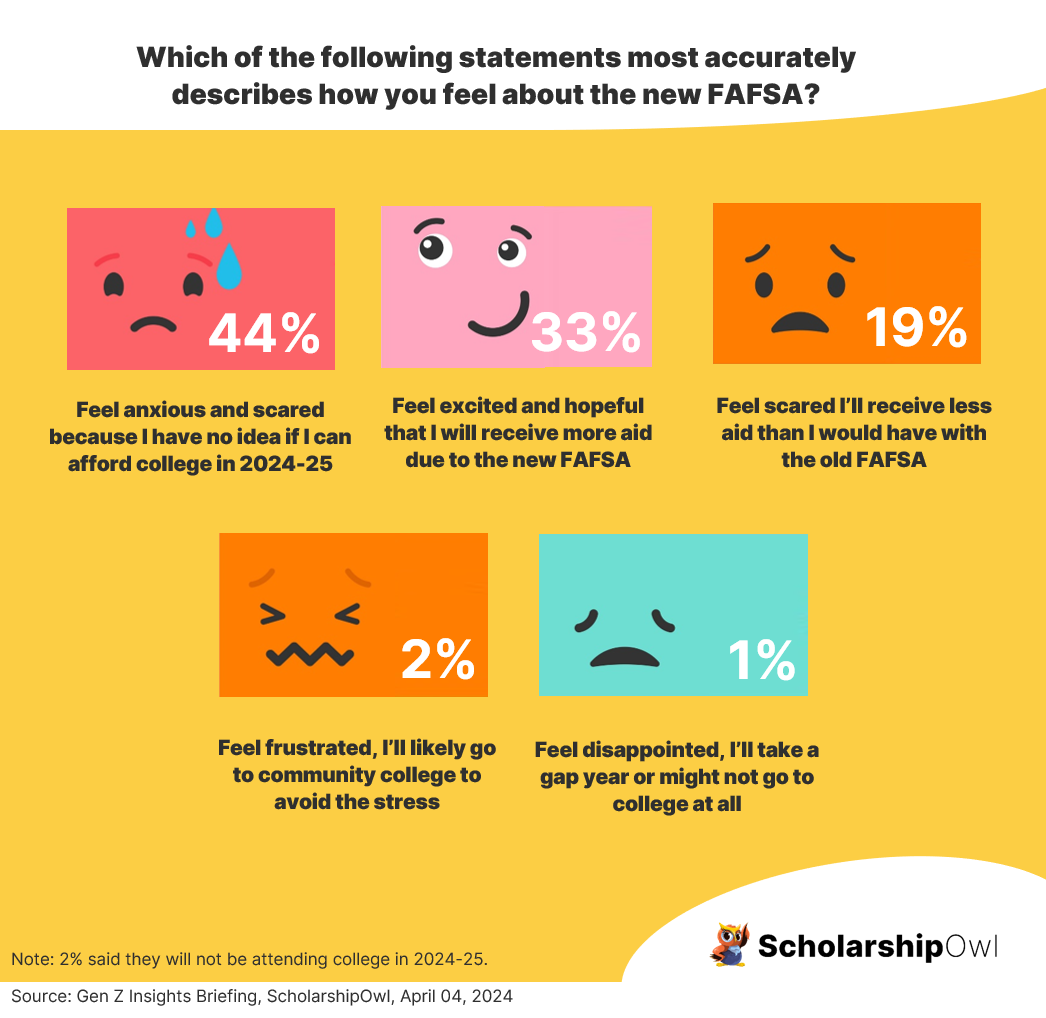

Of the 11,394 college students who participated in our survey, 7764 college students responded to an add-on query: “Which one of many following statements most precisely describes how you’re feeling concerning the modifications to the FAFSA?”

- 44% mentioned they really feel anxious as a result of they do not know if they’ll have the ability to afford school in 2024-25;

- 33% mentioned they’re excited and hopeful that they’ll obtain extra help because of the new FAFSA;

- 19% mentioned they really feel scared that they’ll obtain much less help than they might have with the outdated FAFSA;

- 2% mentioned they really feel pissed off, and that they’ll seemingly go to neighborhood school to keep away from the stress;

- 1% mentioned they really feel disillusioned, and that they’re planning to take a spot yr or presumably not go to school in any respect;

- 2% mentioned they gained’t be attending school in 2023-25.

Key takeaways

The outcomes of our survey point out that a lot of what media retailers are reporting is true – even amongst our college students who’re targeted on making use of for scholarships, there are a major quantity (21%) who haven’t but submitted the brand new FAFSA for the 2024-25 college yr. Amongst our college students who’ve already submitted the FAFSA, simply 16% have acquired a minimum of one monetary help provide from a school. And whereas one-third (33%) of the scholars mentioned they’re excited and hopeful that they’ll obtain extra help because of the new FAFSA, this pales compared to the two-thirds (66%) who say they really feel anxious, scared, pissed off, or disillusioned concerning the new FAFSA.

What can college students do to make sure they will afford school, regardless of the entire challenges with the brand new FAFSA?

There are a variety of steps that college students can take to make sure they’ve an inexpensive path to school:

- For those who plan to attend school in 2024-25, it’s crucial that you just submit your FAFSA straight away. For those who haven’t but, submit it at the moment at www.fafsa.gov.

- Contact your school and/or the entire faculties who’ve provided you admission, and ask them for a standing in your monetary help provide. Ask them if there’s any data or documentation that you would be able to submit that may make it simpler for them to get their monetary help provide to you.

- Prioritize making use of for scholarships with ScholarshipOwl.

- Apply for scholarships from the colleges you’re making use of for and/or are at the moment attending; in the event you’ve already utilized for these scholarships, contact the monetary help workplace to ask for a standing in your software.

- Work part-time in the course of the college yr and full-time throughout breaks. Save your earnings to make use of on your school schooling.

- When you do obtain your monetary help affords, examine them and concentrate on selecting essentially the most inexpensive school. In case your first-choice college provided you a much less monetary help and scholarships than different colleges provided, contact your most well-liked college to see in the event you can negotiate your provide to 1 that’s extra inexpensive for you.

- At all times contemplate beginning at a neighborhood school, which affords a really inexpensive choice – and don’t overlook that neighborhood faculties additionally provide federal and state grant help, they usually additionally provide scholarships. So even if you’re planning to attend neighborhood school, at all times submit your FAFSA and at all times apply for scholarships!

REMEMBER: Pupil loans ought to at all times be a last-resort choice for paying for faculty. Give attention to debt-free sources that may allow you to graduate with out the burden of owing hundreds of {dollars} for faculty! Give attention to making use of for scholarships and jobs, NOT loans, in an effort to graduate debt-free. There IS an inexpensive path to school – for additional data, and to start out making use of for scholarships, go to www.scholarshipowl.com.