Credit score restore is the method of fixing your credit score report, and ideally enhancing your credit score rating.

Below-average credit can restrict your capacity to do a whole lot of issues, together with buying a automotive, residence, getting a bank card, and in some instances, even a job. Being creditworthy definitely has its benefits.

In the event you don’t have good credit score, there are steps you possibly can take to repair it. The method known as credit score restore. You are able to do it by your self or have somebody enable you to, for a price in fact.

Let’s break down what credit score restore is and whether it is price paying somebody to assist restore your credit score.

How Does Credit score Restore Work?

Credit score restore is usually a long-term course of that step by step raises your credit score rating. A credit score rating is a quantity that displays your creditworthiness. The upper the quantity, the higher. In order for you any sort of mortgage or bank card, you’ll want an honest credit score rating.

There are a selection of how to strategy credit score restore and every is exclusive to a selected state of affairs.

Usually although, credit score restore begins with getting a replica of your credit score historical past, and searching for any errors or issues. After you have your credit score historical past, you possibly can start to see what points is likely to be inflicting a decrease credit score rating.

Notice: Ensure you get a replica of your credit score report from all three main credit score bureaus.

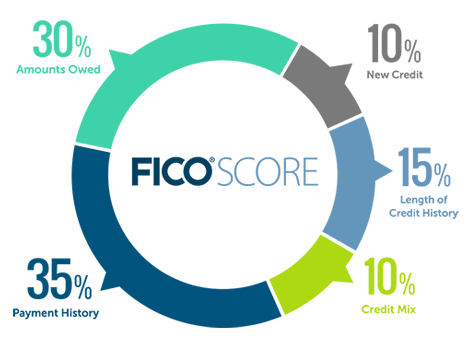

Here is how your FICO Rating is calculated:

Supply: MyFICO

When you see the problems, you can begin addressing them – specializing in the largest areas that influence your credit score rating.

This normally begins with catching up on any late funds. From there, funds are persistently made on time. Being late on a cost is among the worst issues you are able to do to your credit score.

As soon as money owed are made present and also you’ve been making on-time funds, it’s best to begin noticing an improve in your credit score rating. As extra debt is paid down, your rating will proceed to rise.

Can You Do It Your self?

Sure! You’ll be able to completely restore your credit score by your self.

How profitable you’ll be relies on the complexity of your state of affairs. Credit score restore does take time and plenty of analysis — if you’re ranging from the start. However if you’re formidable, repairing your credit score by your self can definitely be finished.

Step one is to get a replica of your credit score report, which you are able to do at AnnualCreditReport.com. Then undergo your report and establish all overdue accounts and something that is likely to be incorrect. You’ll be able to contact every credit score bureau to repair any errors.

Following the steps talked about within the earlier part are a great start line:

- Carry any money owed present by paying overdue quantities and late charges.

- Proceed to make on-time funds.

From there, entry to new credit score can even assist enhance your credit score rating. You probably have a low credit score rating, it’s unlikely any bank card firm will problem you an unsecured bank card. Nonetheless, you possibly can apply and certain get authorized for a secured bank card.

Secured bank cards require a deposit. You’ll be able to spend as much as the deposit quantity. It really works identical to an unsecured bank card besides with a decrease credit score restrict. Your secured bank card actions shall be reported to credit score bureaus, which is what you need.

As an apart, attempt to put away $1,000 in money for an emergency fund. This may assist to pay for emergencies with money fairly than placing them on a bank card. Sudden bills could embody automotive repairs, a damaged sizzling water heater, or a medical invoice.

The FTC web site additionally has some DIY (do-it-yourself) recommendations on its web site right here.

In the event you don’t need to tackle rebuilding your credit score by your self, there are many firms on the market who may also help. However are they price it?

What About Credit score-Constructing Apps And Instruments?

If you are going to do it your self, it’s best to most likely get a credit score monitoring software to begin with. These instruments are typically free, they usually can at the least enable you to monitor your credit score report “dwell”.

That means, as you make progress in your credit score report, you possibly can see the development in your rating.

The most well-liked free instruments are Credit score Karma, Credit score Sesame, and Experian Increase.

In the event you at present have a Chase or American Specific bank card, each of those firms even have a free monitoring software. Chase known as Chase Credit score Journey, and Amex known as My Credit score Information. I personally suppose that the Amex model is healthier.

Paying A Firm to Assist Construct Your Credit score

Having somebody information you thru the credit score restore course of generally is a nice thought for individuals who need extra help. It appears there’s no finish to the variety of firms prepared to take your hard-earned money in trade for a better credit score rating. You’ll be able to anticipate to spend at the least $60/month as much as over $100/month for credit score restore companies throughout 4 to 12 or extra months. The size of time will rely on the complexity of your restore.

In line with a latest research, 48% of customers who used an organization for credit score restore noticed their rating rise by over 100 factors inside 6 months.

A credit score restore service will take a look at your credit score report, put collectively a recreation plan, and have you ever execute on it, whereas checking progress with you every month. You’ll have somebody obtainable to reply your entire questions as effectively.

In case your credit score restore is complicated and also you’re extra comfy talking with somebody as an alternative of researching by yourself, investing a number of months of funds into training and help with a credit score restore firm is likely to be price it. If after a number of months you are feeling comfy executing on the remaining duties on your credit score restore, you possibly can discontinue the service and save a number of hundred {dollars}.

Earlier than you utilize an organization, take a look at this glorious deep dive into the Secret World Of Debt Settlement and perceive what you are probably entering into.

Beneath are firms that present credit score restore companies:

- CreditRepair.com: $14.99 one-time price plus $99.95/month. They declare to extend your credit score rating by 40 factors in 4 months.

- KeyCreditRepair.com: $139.95/month to $189.95/month, relying on the plan. They declare a rise of 90 factors on common in 90 days.

- SkyBlueCredit.com: $79/month. Declare: “Clear up your credit score report. Enhance your scores.”