ScholarshipOwl conducts a survey each month to realize deeper perception about Gen Z college students. In September, we requested college students about their familiarity with the Biden Administration’s latest income-driven scholar mortgage reimbursement plan, the Saving on a Invaluable Schooling (SAVE) Plan. Regardless of strong efforts to advertise the plan by way of social media, sadly simply 46% of the survey respondents indicated they had been acquainted with the plan.

The quickest path to incomes scholarships

Simplify and focus your software course of with the one-stop platform for vetted scholarships.

Who participated within the survey?

In September 2023, ScholarshipOwl surveyed highschool and school college students on the ScholarshipOwl scholarship platform to study extra about their data of the SAVE Plan. A complete of 6,776 college students responded to the survey.

Among the many respondents, 64% had been feminine, 35% had been male, and a couple of% recognized themselves as different. Practically half (46%) had been Caucasian, 22% had been Black, 18% had been Hispanic/Latino, 7% had been Asian/Pacific Islander and seven% recognized as different.

Greater than half (55%) of the respondents had been highschool college students, with the overwhelming majority highschool seniors; over one-third (37%) had been school undergraduate college students, primarily school freshmen and school sophomores; 5% had been graduate college students and three% recognized themselves as grownup/non-traditional college students.

Survey questions

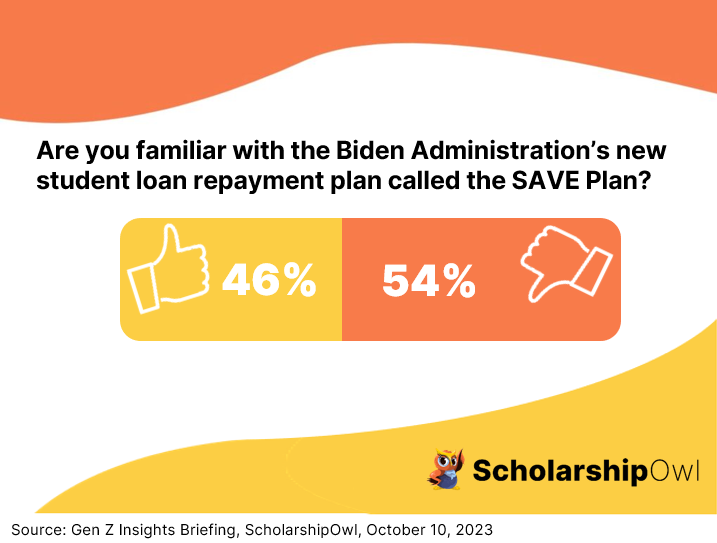

The primary survey query was “Are you acquainted with the Biden Administration’s new scholar mortgage reimbursement plan referred to as the Saving on a Invaluable Schooling (SAVE) Plan?” Lower than half (46%) mentioned they had been acquainted with the SAVE Plan, with the remainder of the respondents (54%) saying they weren’t.

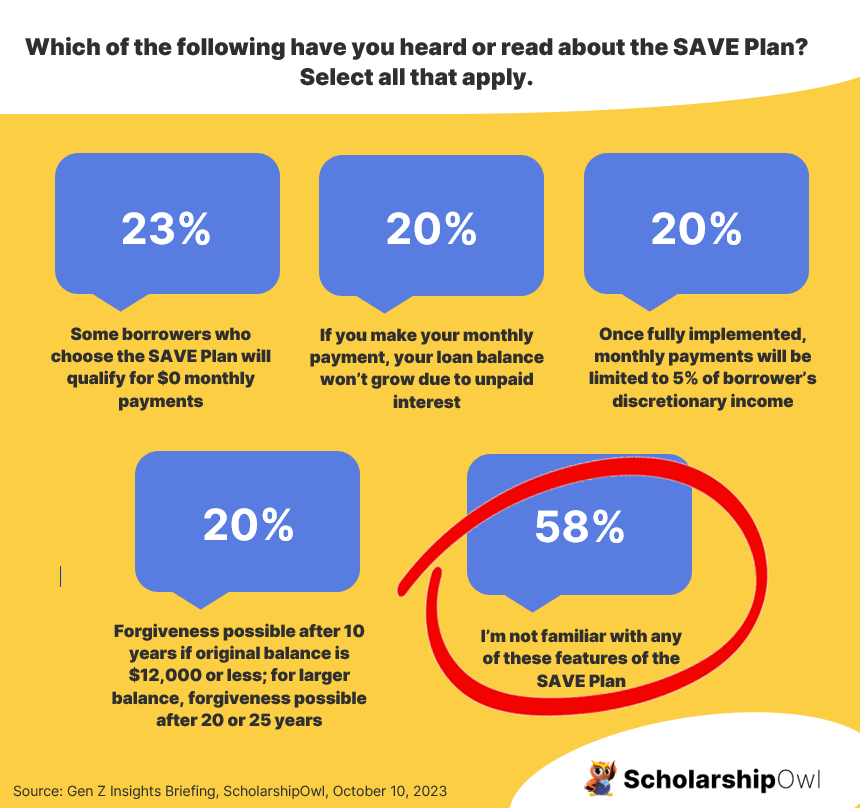

We then requested, “Which of the next have you ever heard or learn concerning the SAVE Plan? Test all that apply.”

Practically one-quarter (23%) mentioned that they had been conscious that some debtors who select the SAVE Plan will qualify for $0 month-to-month funds. One-fifth (20%) had heard that if a scholar makes their month-to-month fee, their mortgage stability wouldn’t develop because of unpaid curiosity. One-fifth (20%) had heard that after the SAVE Plan is totally applied in July 2024, month-to-month funds on undergraduate loans shall be restricted to five% of the borrower’s discretionary revenue, slightly than the present 10% cap. One-fifth (20%) are conscious of the trail to mortgage forgiveness obtainable to college students who select the SAVE Plan – debtors with an authentic principal stability of $12,000 or much less will obtain forgiveness after 10 years of well timed funds; for every $1000 borrowed above that quantity, a further 12 months of well timed funds shall be required for forgiveness, as much as a most of 20 or 25 years. Sadly, 58% responded that they weren’t acquainted with any of those points of the SAVE Plan.

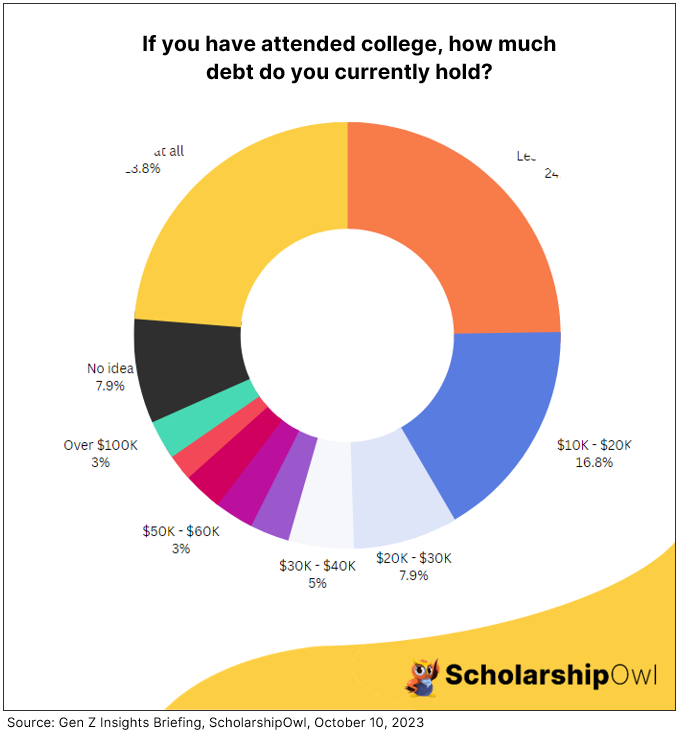

For the ultimate survey query, we had been all in favour of how a lot scholar debt respondents at the moment maintain. Since highschool college students don’t but have scholar debt, we seemed on the responses solely from the scholars which have attended school now or prior to now, totaling 3079 respondents. We requested these college students, “In whole, how a lot scholar debt do you at the moment maintain?”

General, greater than three-quarters (76%) have already got scholar debt. That is very regarding, as the vast majority of these respondents are of their first or second 12 months of school, and should effectively tackle much more debt earlier than they graduate. One quarter (25%) of the respondents indicated they’ve lower than $10,000 in scholar debt. Multiple-sixth (17%) indicated they owe $10,000 to $20,000 in scholar debt, whereas 8% said they owe $20,000 – $30,000 in scholar debt. 5 p.c (5%) maintain $30,000 to $40,000 in scholar debt. Simply over one-tenth (11%) owe $40,000 to $80,000 in scholar debt, with 3% indicating they owe greater than $100,000 in scholar loans. Concerningly, 8% of respondents said that they’d no thought how a lot scholar debt they’ve. On the constructive facet, slightly below one-quarter (24%) said that they at the moment would not have any scholar debt.

Key takeaways for Gen Z college students

The survey outcomes point out that the Biden Administration’s advertising and marketing and social media marketing campaign selling the SAVE Plan has sadly been insufficient, with lower than half of Gen Z college students (46%) having any familiarity with this new reimbursement plan choice. The SAVE Plan provides quite a few advantages for Gen Z college students – and typically, when debtors take a look at all of their reimbursement choices, the SAVE Plan could have important benefit over the opposite plans:

The SAVE Plan provides the next advantages proper now:

- Decreases month-to-month funds by rising the revenue exemption from 150% to 225% of the poverty line. This implies SAVE can considerably lower your month-to-month fee when in comparison with what your fee can be with different income-driven reimbursement plans. Some debtors might even qualify for a $0 month-to-month fee, relying on their revenue and household dimension. Go to the SAVE Plan to search out out extra.

- The SAVE Plan eliminates 100% of remaining month-to-month curiosity for each sponsored and unsubsidized loans after making your scheduled fee. Which means with the SAVE Plan, your mortgage stability received’t develop because of unpaid curiosity that accrued since your final fee.

- If you’re married and file your taxes individually, the SAVE Plan excludes your partner’s revenue when figuring out your month-to-month fee quantity.

In July 2024, when the SAVE Plan is totally applied, debtors will take pleasure in these extra advantages:

- Your month-to-month fee shall be capped at simply 5% of your discretionary revenue, which means that in July of subsequent 12 months, your funds shall be reduce in half!

- In case you have an authentic principal stability of $12,000 or much less, you’ll obtain forgiveness of any remaining stability after 10 years of funds. For every $1000 borrowed above that quantity, a further 12 months of well timed funds shall be required for forgiveness, as much as a most of 20 years for debtors with solely undergraduate loans, or 25 years for debtors who’ve graduate faculty loans.

- In case you consolidate your loans, you’ll retain the progress you’ve made towards forgiveness within the type of “credit.” You’ll obtain credit score for a weighted common of funds that rely towards forgiveness of the loans being consolidated.

- You’ll mechanically obtain credit score towards forgiveness for particular intervals of deferment and forbearance – this consists of intervals of deferment earlier than July 1, 2024. Observe that credit score for forbearances shall be relevant solely to forbearances acquired on or after July 1, 2024. You’ll additionally be capable of make extra “buyback” funds to get credit score for many different intervals of deferment or forbearance.

Assist! My scholar loans at the moment are in reimbursement. What ought to I do?

The coed mortgage fee pause ended on October 01, 2023. If you’re nonetheless at school, you’ll be able to proceed to defer fee in your loans. However in case you are not a at the moment enrolled scholar, your loans at the moment are in reimbursement. Whereas that could be a bit scary to consider – particularly once we are all fighting inflation, an important essential factor to recollect is that burying your head within the sand received’t show you how to… However your mortgage servicer will! So take these steps:

- Go to StudentAid.gov to search out out who’s at the moment servicing your mortgage. Throughout the pandemic, many loans had been offered to different servicers, so there’s a excessive probability that your mortgage has modified palms.

- Go to your mortgage servicer’s web site, and create an account or login to your present account and discover out the quantity of your mortgage fee in addition to your fee due date.

- Discover reimbursement plan choices, together with the SAVE Plan. Choose the reimbursement plan that finest meets your wants.

- In case you need assistance choosing a reimbursement plan, name your mortgage servicer for help. You’ll want to ask concerning the SAVE Plan!

Is it attainable to pay for school with out the burden of scholar debt?

YES! In case you don’t but have any scholar loans, or if you have already got loans however need to keep away from taking up extra debt, there IS a manner! Use debt-free sources to pay for school as a substitute:

- Entry federal and state grant support by submitting the FAFSA.

- Prioritize making use of for scholarships with ScholarshipOwl.

- Work part-time throughout the faculty 12 months and full-time throughout breaks. Apply your earnings towards your school training.

- Select a extra inexpensive path to varsity, reminiscent of by beginning at a neighborhood school.

You CAN go to varsity with out taking out scholar loans!