Most college students know that the best way to use for federal scholar support is thru the FAFSA – the Free Utility for Federal Scholar Support. However if in case you have filed the FAFSA in earlier years, it is very important know that the FAFSA is altering.

Among the adjustments are pretty minor, and have already applied within the final couple of years – however the FAFSA that shall be opening quickly shall be very completely different from the earlier FAFSA. Lots of the adjustments are constructive, particularly for college kids with important monetary want; nonetheless, middle-income college students might discover that the adjustments cut back their alternative to acquire federal grant support. Checkout our FAFSA FAQ under to seek out out every thing that you must know!

What sort of economic support can I qualify for with the FAFSA?

The quickest path to incomes scholarships

Simplify and focus your utility course of with the one-stop platform for vetted scholarships.

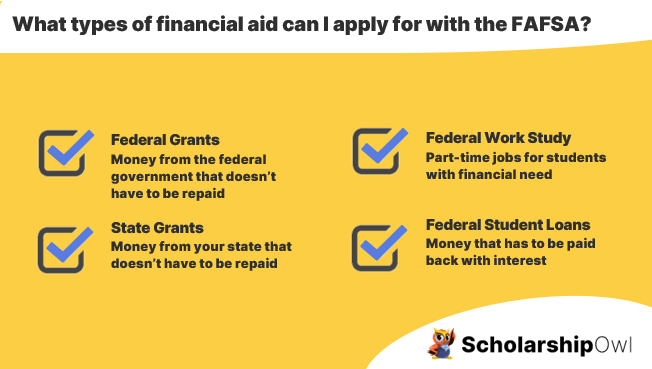

If you submit the FAFSA, you’ll be submitting monetary knowledge that may decide your eligibility for every of the next:

- Federal grants – cash you need to use to pay for school that doesn’t should be paid again. Accessible grants embody the Federal Pell Grant, the Federal Supplemental Instructional Alternative Grant (FSEOG), Iraq and Afghanistan Service Grant, Instructor Training Help for School and Larger Training (TEACH) Grant.

- State grants – in case your state affords grants for school, your state will use the FAFSA to find out in case your eligibility for these grants

- Federal work-study – part-time jobs for undergraduate and graduate college students with monetary want

- Federal scholar loans – cash you may borrow to pay for school, however that you could pay again with curiosity

Why has the FAFSA modified?

Adjustments have been made to the FAFSA for a number of causes:

- To simplify and streamline the FAFSA utility course of

- To enhance accuracy of the information submitted

- To cut back the probability of getting to finish and submit verification paperwork

- To make sure that federal grant support is focused to the scholars with the best monetary want

Will these adjustments cut back the variety of college students who qualify for a federal Pell Grant?

No! The excellent news is that these adjustments are anticipated to improve the variety of college students who obtain a federal Pell Grant. In actual fact, it’s anticipated that 1.5 million MORE college students will obtain the utmost Pell Grant because of these adjustments, bringing the entire variety of college students who obtain the utmost quantity to five.2 million college students! It’s because Pell Grant eligibility is now linked to household measurement and the federal poverty stage, serving to to considerably broaden entry to federal scholar support. As well as, as a result of the FAFSA utility shall be quicker and simpler to finish, it’s hoped that many extra households will resolve to finish and submit the FAFSA.

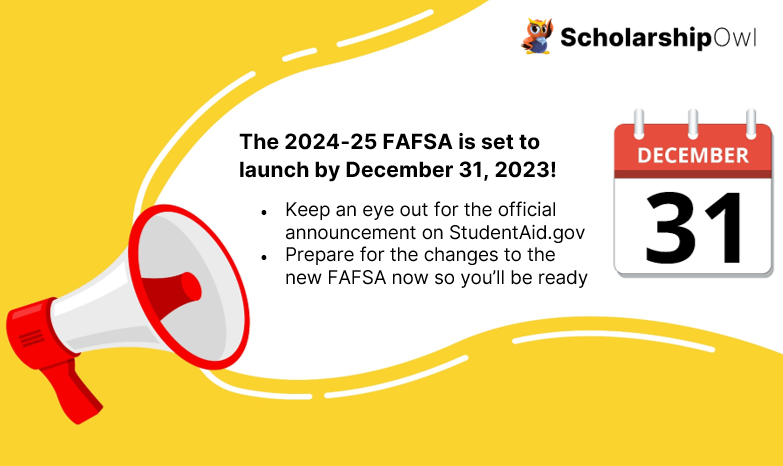

When can I submit the FAFSA?

Lately, the FAFSA has opened on October 1st, however for the 2024-25 FAFSA, you gained’t be capable to begin your utility till late-December. At the moment, the FAFSA is about to launch by December 31, 2023, however it’s attainable that it might be delayed till January.

Will the brand new FAFSA type be simpler or harder to finish than in earlier years?

The brand new FAFSA is less complicated and simpler to finish, which is nice information! There at the moment are simply 36 questions as an alternative of 108! In actual fact, relying on your loved ones and earnings scenario, you may solely want to finish 18 of the 36 questions!

Why is the brand new FAFSA a lot quicker to finish? How is it attainable that there are so few questions now?

The brand new FAFSA requires automated switch of IRS knowledge to the FAFSA. This has been accessible on the previous FAFSA for a number of years, however now it’s required. As a result of the federal earnings knowledge is transferred mechanically reduces the variety of questions that must be requested on the FAFSA type. It additionally reduces the prospect for error, and can cut back the probability that college students shall be requested to finish verification paperwork in a while.

How is monetary want decided with the brand new FAFSA?

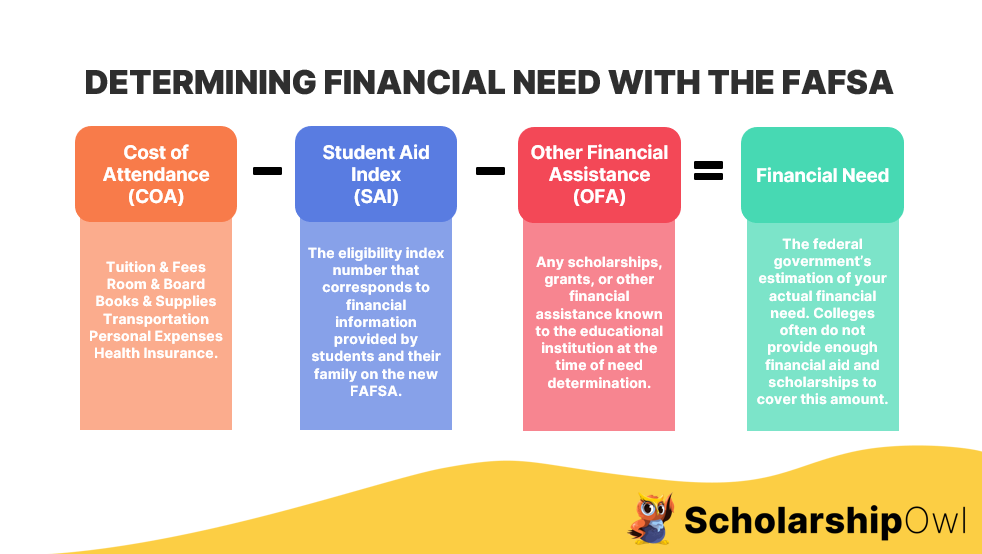

To find out your monetary want, the school’s monetary support consultant makes use of a easy equation. With the previous FAFSA, they subtracted your “Anticipated Household Contribution” (EFC) from the entire Value of Attendance (COA). The end result was your monetary want. However with the brand new FAFSA, the best way that monetary want is set has modified.

- The brand new FAFSA not makes use of the time period “Anticipated Household Contribution.” College students and households discovered this terminology to be complicated, so now as an alternative of EFC, the brand new FAFSA makes use of the time period “Scholar Support Index” (SAI). The SAI is an eligibility index quantity {that a} faculty monetary support officer makes use of to find out how a lot federal scholar support the scholar might obtain if the scholar attends the college. This quantity outcomes from the data that the scholar and their household gives of their FAFSA type. The SAI capabilities in an identical option to the EFC.

- When calculating monetary want, the monetary support officer subtracts the SAI from the COA, and ALSO subtracts any Different Monetary Help (OFA), to reach on the scholar’s monetary want. Examples of OFA may very well be exterior scholarships or grants, for instance, or different monetary help that the monetary support officer is aware of about on the time they’re figuring out monetary want. So the NEW FORMULA is COA – SAI – OFA = Monetary Want.

How will I do know if I’m eligible for the federal Pell Grant by means of the FAFSA?

When you submit your FAFSA, you’ll obtain your Scholar Support Indext (SAI) quantity. This replaces the previous Anticipated Household Contribution (EFC) quantity. One factor that’s completely different between the previous EFC and the brand new SAI: The SAI quantity may very well be a damaging quantity. In case your SAI is between -1500 and 0, you’ll qualify to obtain the utmost Pell Grant of $7395. In case your SAI quantity is greater than 0, you should still qualify for a Pell Grant, based mostly on your loved ones measurement, adjusted gross earnings, and poverty tips, however the quantity you obtain could also be lower than the utmost Pell Grant.

My mother and father don’t dwell collectively. Do each of my mother and father want to offer their monetary knowledge for the FAFSA?

For college kids who’s mother and father are divorced, separated or by no means married and don’t dwell collectively, just one mother or father wants to finish the FAFSA. Previously, the mother or father who the scholar lived with essentially the most wanted to offer their monetary knowledge on the FAFSA; nonetheless, with the brand new FAFSA, the mother or father who gives essentially the most monetary help to you is now liable for offering their monetary knowledge. Notice that if this mother or father has remarried, the stepparent’s earnings, belongings and dependents should even be reported on the FAFSA.

I’m from a single-parent family. Is it doubtless that I’ll qualify for federal need-based support?

For dependent college students with only one mother or father, OR impartial college students who’re single mother and father themselves, there’s some excellent news – the brand new FAFSA might allow you to have better eligibility for need-based support. So this can be a doubtlessly constructive change, however keep in mind, although college students in these conditions might have elevated eligibility, it doesn’t imply that you simply WILL qualify for federal grants. It simply implies that you MAY be eligible, relying in your family earnings and belongings.

My sibling and I are each going to be in faculty on the similar time. Are we prone to qualify for federal need-based support?

One large change that may impact households with a number of college students in faculty on the similar time is that the brand new FAFSA will not mean you can “profit” from this. In different phrases, for those who and your sibling(s) are in faculty on the similar time, the FAFSA not considers that in your federal monetary support willpower. For low-income households, this gained’t have important influence; nonetheless, for middle-income and upper-income households, you could discover that you’ve much less eligibility for federal need-based support.

What occurs after I submit the FAFSA?

When you have just lately utilized to schools, you should definitely keep watch over the portals for ALL of the universities you’ve utilized to. You’ll must examine the monetary support part of your portals to see if that you must submit any further data or verification paperwork. Anticipate to attend awhile for every of the universities to current you with their monetary support supply. Whereas this has at all times been a difficult wait, it will likely be extra so now for the reason that FAFSA is new, and the calculation course of has modified, so it’s a studying curve for everybody, together with monetary support officers. Notice that many faculties gained’t work in your monetary support file till AFTER they’ve despatched out a suggestion of admission – which could be irritating. Non-public and out of state faculties do typically supply a scholarship on the time an admission supply is made, however even then, they could not have but decided whether or not or not you’ll obtain any state or federal grant support.

In case you are presently attending faculty, examine along with your monetary support officer to seek out out if that you must submit any further data. Remember that as a result of the federal monetary support system has modified, that the quantity of federal support you obtain within the 2024-25 college yr could also be completely different that what you obtained this yr.

What sort of economic support will I see in my monetary support supply?

Your monetary support supply may embody a mix of federal and/or state grants, scholar loans, work examine, scholarships, and so on. Or it would embody just one or two of these. Many college students are provided loans solely – all of it will depend on your Scholar Support Index (SAI) quantity, in addition to how a lot funding is on the market. In case you just lately utilized to schools, make sure that you perceive your full monetary support and scholarship bundle from every faculty earlier than accepting a suggestion of admission. When you have questions, follow-up with the monetary support workplace of the school(s) you might be contemplating.

I nonetheless have questions concerning the FAFSA. The place can I discover further data?

To seek out out extra concerning the new FAFSA, go to the federal scholar support web site. You can even contact the monetary support workplace at your faculty, or on the faculty you might be making use of to.

Assist! I don’t suppose I can afford faculty! What can I do?

Many college students fear that they gained’t be capable to pay for school. But it surely IS attainable to go to school with out taking up the burden of scholar debt. Right here’s how:

- Entry federal and state grant support by submitting the FAFSA.

- Prioritize making use of for scholarships with ScholarshipOwl.

- Work part-time throughout the college yr and full-time throughout breaks. Use your earnings to pay for school.

- Select a extra inexpensive faculty, reminiscent of by beginning at a neighborhood faculty.

Keep in mind: All the time apply for scholarships and jobs, NOT loans, so you may graduate debt-free. There IS an inexpensive path to school – for additional data, and to start out making use of for scholarships, go to www.scholarshipowl.com.