ScholarshipOwl conducts a survey every month to develop a deeper understanding of Gen Z. In Might, we continued our latest deep-dive into the influence of scholar debt by asking college students about how their scholar loans will have an effect on their future after they graduate school. Based mostly on the outcomes, it’s clear that there will likely be important influence. Amongst all respondents, the overwhelming majority (87%) indicated they’ve scholar debt that must be repaid.

Who participated within the survey?

In Might 2023, ScholarshipOwl surveyed over 10,000 highschool and school college students on the ScholarshipOwl scholarship platform to learn the way ready they’re for the resumption of scholar mortgage funds, which is able to start 60 days after June 30, 2023. We had been significantly focused on discovering out how scholar debt will influence the decision-making of scholars after they graduate. A complete of 10,624 college students responded to the survey.

Among the many respondents, 64% had been feminine, 34% had been male, and a couple of% recognized themselves as different. Almost half (45%) had been Caucasian, 25% had been Black, 17% had been Hispanic/Latino, 6% had been Asian/Pacific Islander and seven% recognized as different.

The quickest path to incomes scholarships

Simplify and focus your software course of with the one-stop platform for vetted scholarships.

Almost half (48%) of the respondents had been highschool college students, with the overwhelming majority highschool seniors; 41% had been school undergraduate college students, primarily school freshmen and school sophomores; 8% had been graduate college students and 4% recognized themselves as grownup/non-traditional college students.

Background

Scholar mortgage funds have been paused for over three years on account of the COVID-19 pandemic. Though the Biden Administration has prolonged the fee pause, latest laws commits the Administration to resuming mortgage funds 60 days after June 30, 2023. As such, further extensions is not going to be potential. Debtors want to organize themselves for this variation, which could have important influence on their means to accommodate mortgage funds together with different residing bills. This will likely be significantly difficult because of present financial circumstances involving inflation, increased rates of interest on mortgages, in addition to layoffs in lots of sectors.

Survey questions

The primary survey query was “Pondering forward to your school commencement and holding in thoughts the present financial circumstances, how difficult do you suppose it is going to be to safe a job associated to your main?”

Greater than three-quarters (83%) responded that it will be a minimum of considerably difficult for them to safe a job associated to their main. Solely 17% mentioned that they didn’t suppose it will be difficult in any respect.

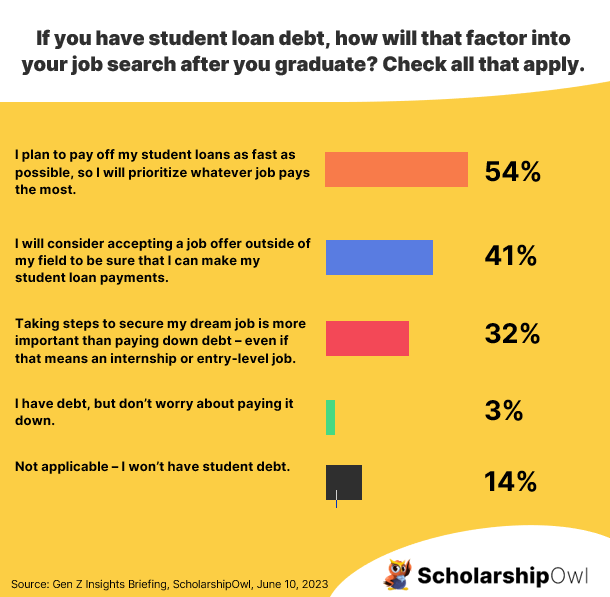

As a follow-up query, we requested, “When you have scholar mortgage debt, how will that issue into your job search after you graduate? Examine all that apply.” Over half of the respondents (54%) mentioned that they plan to repay their scholar loans as quick as potential, and that they may prioritize no matter job pays essentially the most to allow them to take action. Almost half (41%) indicated that they may think about accepting a job exterior of their area to make certain they will make their mortgage funds. Alternatively, practically one-third (32%) mentioned that taking steps to safe their dream job is extra vital than paying down debt, even when meaning beginning with an internship or entry-level job of their area. Simply 3% mentioned that they’ve scholar debt however should not fearful about paying it down. Solely 14% of the respondents reported that they gained’t have any scholar debt in any respect.

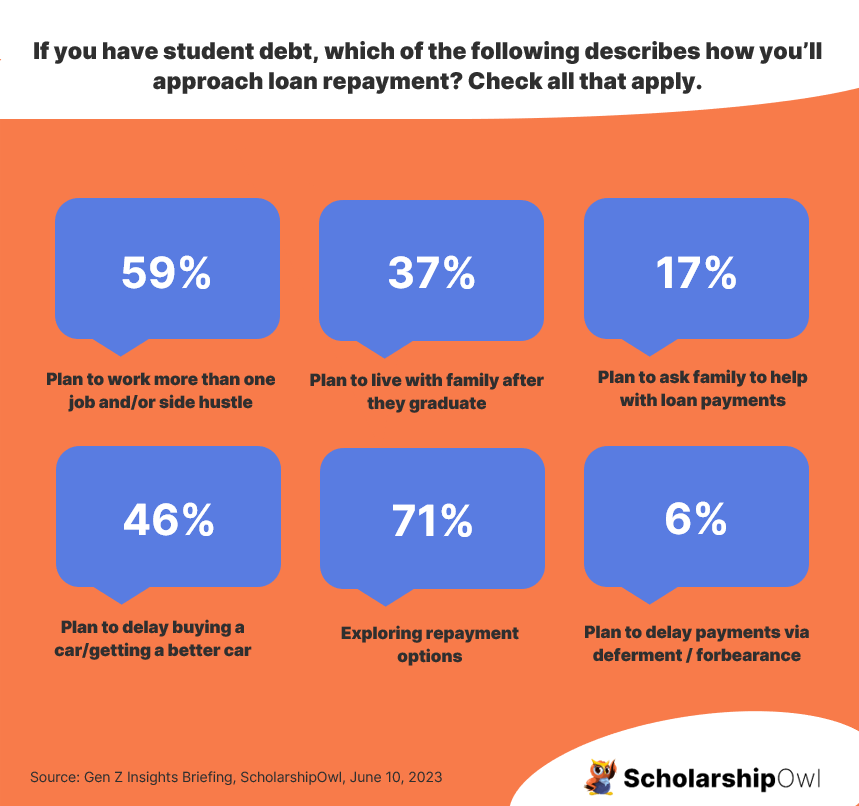

The ultimate survey query was “When you have scholar mortgage debt, which of the next describes the way you’ll method scholar mortgage reimbursement? Examine all that apply.” Amongst those that had been surveyed, practically two-thirds (59%) of respondents indicated that they deliberate to work a couple of job and/or tackle a facet hustle to make sure they might make their scholar mortgage funds. Over one-third (37%) plan to reside with household after they graduate moderately than residing on their very own instantly, and 17% plan to really ask household to assist them with their mortgage funds.

Lots of the respondents plan on delaying main milestones, with practically half (46%) planning to delay shopping for a automobile or getting a greater automobile; one-quarter (25%) planning to delay marriage; half (50%) planning to delay shopping for a house. Almost three-quarters (71%) are exploring reimbursement choices – 30% are contemplating consolidating their loans right into a single mortgage to simplify the fee course of, and 41% are planning to pick out an income-based reimbursement plan that permits them to make decrease funds initially till their earnings will increase. A small minority (6%) plan to delay making their mortgage funds so long as probably by deferment and forbearance choices.

Maybe most vital, the overwhelming majority (87%) indicated they’ve scholar debt that will should be repaid.

Key Takeaways for Gen Z college students

The survey outcomes point out that Gen Z college students perceive that challenges offered by the present financial circumstances, with the overwhelming majority involved about discovering a job associated to their main. On the optimistic facet, scholar mortgage debtors are planning forward to handle mortgage funds, and the bulk are ready to make troublesome choices with a view to keep on prime of their loans. Most respondents demonstrated consciousness of borrower choices together with mortgage consolidation and income-based reimbursement plans. These sorts of choices supply higher flexibility, and likewise assist debtors to remain on observe in making their mortgage funds. Lastly, 13% of respondents had been capable of keep away from the burden of scholar debt by paying for school by scholarships, grants, private earnings, and household help. Whereas that is excellent news for these college students, this additionally signifies that the overwhelming majority (87%) of the scholars surveyed have scholar debt that they might want to repay – this clearly demonstrates that college students and households want options to keep away from utilizing loans to pay for school.

Manufacturers might be the answer

There are merely not sufficient scholarships out there to help the thousands and thousands of scholars who want them. Manufacturers might help by providing scholarship campaigns by the ScholarshipOwl for Enterprise platform to help college students, whereas additionally fulfilling their enterprise and philanthropic objectives. By means of this platform, manufacturers can shortly and simply create and launch scholarship campaigns to achieve thousands and thousands of scholars who apply for scholarships on the ScholarshipOwl platform. This each advantages college students and types, enabling companies to construct relationships with Gen Z in help of their advertising and communication objectives.

To search out out extra about creating and launching a scholarship marketing campaign, go to enterprise.scholarshipowl.com.