BIG Concepts:

- A debt-to-income ratio (DTI) is a calculation that lenders use to find out whether or not you possibly can or can not qualify for a mortgage.

- The decrease your DTI ratio, the higher your probabilities of getting accredited for a mortgage.

- Paying down present debt, avoiding new credit score, and consolidating higher-interest loans might help you scale back your DTI.

Let’s face it, the world of scholar loans is usually a little complicated at occasions particularly with regards to understanding the acronyms and terminology that’s typically thrown round like FAFSA, PLUS, or APR.

For those who apply for a mortgage, one time period you’ll hear so much about is DTI or debt-to-income ratio. It’s a time period it’s best to know for a vital cause – it helps decide whether or not you’ll qualify for that mortgage.

Good to know, proper?

Along with your credit score rating, your DTI ratio is likely one of the foremost elements that lenders take a look at to find out whether or not or not you’ll be capable to afford the month-to-month fee on the scholar mortgage you want. And, the decrease it’s, the higher your probabilities of getting accredited.

Right here’s a fast examine on DTI and how one can enhance yours:

How your DTI is calculated

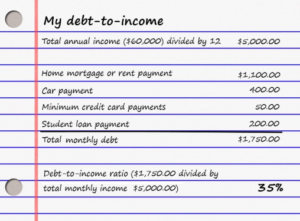

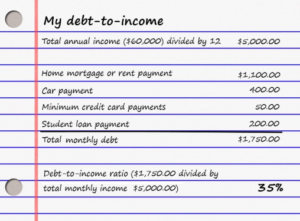

You don’t should be a Math main to find out your DTI. It’s a fairly easy calculation: it’s your month-to-month debt funds divided by your common month-to-month revenue. Right here’s tips on how to go about figuring out yours:

- Add up all your annual revenue and divide by 12.

- Make a listing of your month-to-month debt funds and add them up. You possibly can sometimes discover them by checking your month-to-month statements out of your present lenders. You should definitely use the minimal month-to-month fee for bank cards, even if you happen to pay further every month. If in case you have a credit score account that has no month-to-month minimal fee, lenders might select to make use of a share (1-3%) of the present or unique stability to estimate the month-to-month fee. When you’ve collected the month-to-month debt funds, merely add them up.

- Divide your whole debt funds by your month-to-month revenue.

Instance: After including up your revenue and bills, you identify that your month-to-month revenue (your annual revenue / 12) is $5,000 and your bills are $1,750 per 30 days. Dividing your bills by your month-to-month revenue provides you with your DTI, which on this case is .35 or 35%. Normally, lenders take a look at your gross month-to-month revenue, which is the sum of money you make earlier than taxes are taken out.

What money owed and revenue are included in your DTI?

Now that you understand how DTI ratios are calculated, you will get a bit of extra exact with your personal numbers. Completely different lenders might use completely different money owed throughout their calculations, however most embrace the next:

- Mortgage or hire funds

- Dwelling insurance coverage funds

- Property tax funds

- Householders’ affiliation charges

- Automotive funds

- Pupil mortgage funds

- Youngster assist funds

- Alimony funds

- Minimal bank card funds

- Private mortgage funds

Word: Utility payments, groceries, and fuel are excluded out of your DTI. In some situations, if you happen to’re refinancing one other mortgage, the lender will ignore the month-to-month fee of the mortgage being refinanced and calculate your DTI with the month-to-month fee of the brand new mortgage.

So far as revenue goes, lenders will take a look at your month-to-month revenue earlier than taxes. This will embrace:

- All wages

- Commissions

- Bonuses

- Self-employment revenue

- Funding revenue

- Youngster Assist or alimony

Usually, a lender will take the annual quantity of all your revenue and divide the quantity by 12 to reach at your estimated month-to-month revenue.

Methods to decrease your debt-to-income ratio

Reducing your DTI can undoubtedly enhance your probabilities of being accredited for a scholar mortgage. You possibly can accomplish that by rising your month-to-month revenue, although that will not be a sensible possibility. Or, you possibly can take a neater possibility, decreasing your debt. Listed below are some methods to perform that:

- Pay down bank card debt. Reducing the stability in your bank card will decrease the required month-to-month fee and in the end enhance your DTI ratio.

- Don’t tackle new debt. It sounds foolish however must be stated. Keep away from massive purchases and don’t open new credit score accounts. As a substitute, give attention to paying down your money owed as a lot as attainable.

- Reconfigure your debt. If in case you have good credit score however wish to enhance your DTI ratio, reconfiguring your debt may end up in a decrease month-to-month debt fee. You are able to do this by refinancing or extending the time period of a mortgage. For those who select any of those choices, you do want to concentrate on the results. Refinancing typically has charges and different prices related to it and lengthening the time period of the mortgage will result in you paying extra in curiosity over the lifetime of the mortgage.

- Take out a debt consolidation mortgage. If in case you have a number of high-interest bank cards, paying them off and in the end consolidating that debt below one mortgage can prevent cash and decrease your month-to-month debt funds. This selection solely works properly if you happen to’re dedicated to not working the balances again up in your bank cards.

Like enhancing your credit score rating, enhancing your debt-to-income ratio can take a little bit of time, however there are steps you can begin taking as we speak that may enhance it.

We’re right here that can assist you each step of the best way

Want a bit of assist getting the scholar mortgage you want? For greater than 40 years, Brazos Larger Training has been providing useful steerage and assist to make training attainable. As a Texas non-profit, we are able to give you BIG financial savings on a variety of personal loans for college students and fogeys. Contact us as we speak.