The Biden-Harris Administration introduced it should grant forgiveness to debtors on the Saving on a Helpful Schooling (SAVE) Plan starting in February. Debtors who initially took out $12,000 or much less for school and make ten years of funds could have their money owed canceled.

The SAVE plan replaces the REPAYE income-driven compensation plan, which permits for mortgage forgiveness of the total stability after 20 or 25 years. Beneath the SAVE plan, for each $1,000 borrowed above $12,000, a borrower can obtain forgiveness after an extra yr of funds. This implies most debtors with a stability lower than $21,000 will nonetheless attain forgiveness sooner than the unique 20-year timeline.

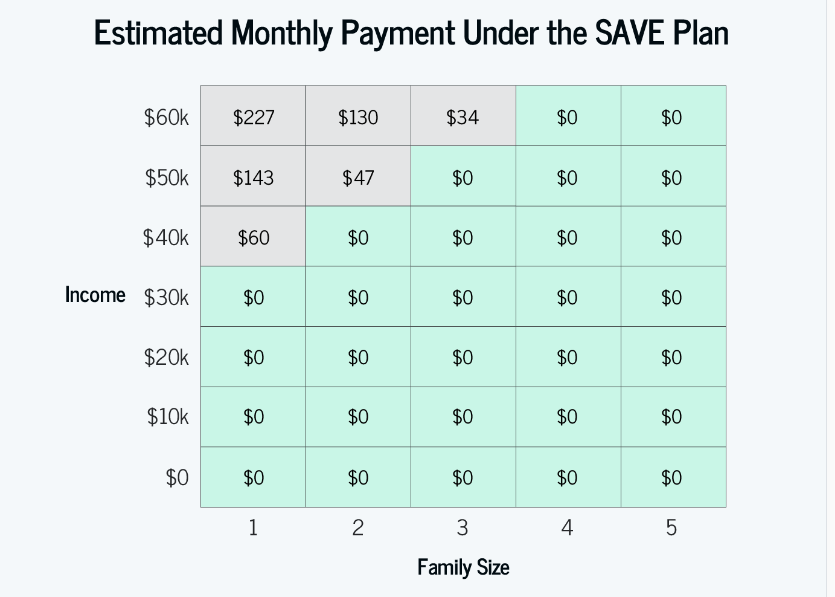

The SAVE plan might be absolutely applied this July, and debtors are inspired to enroll now. Based mostly on the earnings ranges of scholar mortgage debtors, over 60% of debtors would qualify for a considerably lowered month-to-month cost.

Because the Commonplace Reimbursement plan for Federal Direct loans can also be 10 years, it’s to most debtors’ benefit to enroll in SAVE.

Earlier Funds and the Reimbursement Pause Years Might Qualify and Trigger Instant Forgiveness

If a borrower has already been repaying for 10 years, these years may rely in direction of mortgage forgiveness. This consists of the three-year cost pause, even when no funds have been made.

“Intervals that rely towards the forgiveness advantages embody months in the course of the cost pause and time in compensation as decided via the cost rely adjustment.”

Debtors on SAVE might be notified in February if they’re eligible for speedy discharge. In case you haven’t already enrolled in SAVE, log in to the ION portal and join with a mortgage compensation counselor to get began.